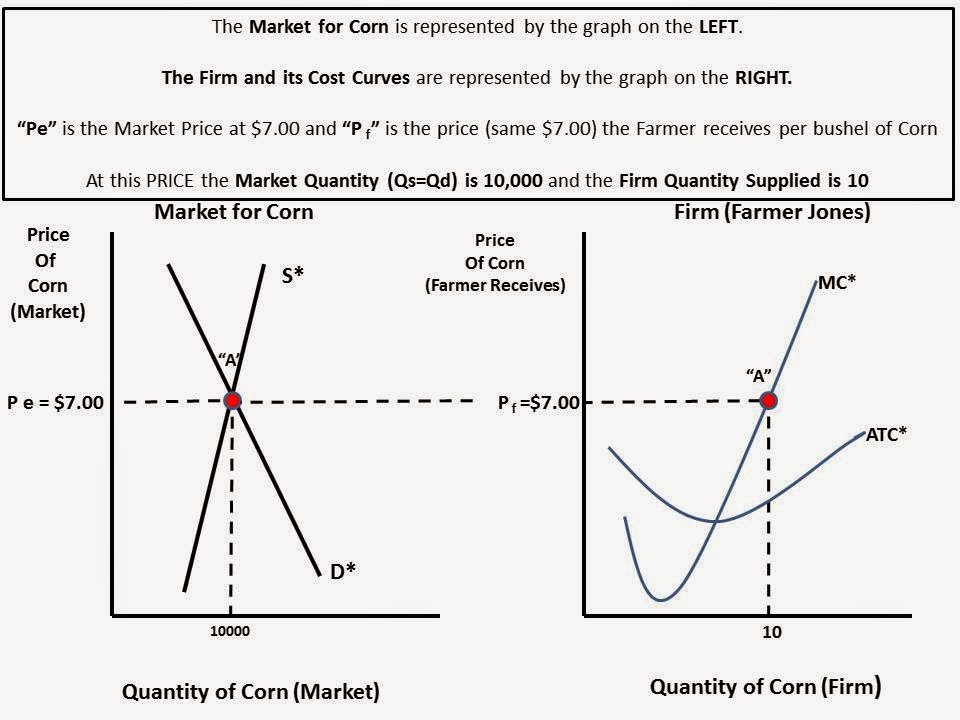

A current event gives me an opportunity to create a series of graphs to illustrate what happens to "Economic Profits"in a market that is considered "Perfectly Competitive" when there is a price decrease AND the cost structure remains relatively constant.

Ohio corn farmers might be producing more crops, but the boom in supply and higher expenses are driving down profits this year.

Most farmers are reporting they are producing more bushels this year, but the price they're able to get for the commodity has been roughly cut in half compared to last year.

Western Ohio farmer Tom Tullis said he regularly saw corn prices as high as $6.50 or $7 per bushel as late as last year. But prices this year have been closer to $3. At the same time, operating costs such as machinery and fertilizer have remained high. (Note: I read that "constant")

"It's about half price or below what it was last year," Tullis told the Dayton Daily News (http://bit.ly/1uwu8jN ). "And our inputs are staying pretty much in the same place as far as fertilizer, chemicals and everything else. It's going to be a tough one."

Most farmers will have enough assets to withstand a tough year or two, said Matt Roberts, an agricultural economist for Ohio State University Extension. The majority of farmers across the state will likely break even this year, Roberts said, although there will be some who lose money."In the graphs below, I use $7.00 as last years price and $3.50 as this years price. I use $3.50 as the Average Total Cost (ATC) of producing because it is suggested in the article that farmers are either making a small profit at that level or might even be losing money at that cost. In other words, it is the rough "break-even" point.

No comments:

Post a Comment