Going to buy the baby some new shoes!!

Got this idea from Mark Perry. Go HERE for more on the subject of Tariffs on imported shoes, which is the crux of this posting.

How much in taxes, that we can actually figure out, goes to purchase a $10.00 pair of basic rubber sole canvas sneakers for a child. We HAVE to assume these are imported from China because there is NO domestic producer of this type of shoe.

Well, I have to earn the money first. So the first taxes I encounter of payroll taxes--Social Security, 6.2% of what I make and Medicare, 1.45% of what I make. So a total of 7.65% of my income.

I calculate I would (roughly) have to earn $10.85 before taxes.

Minus Payroll Taxes (Social Security (6.2%) and Medicare (1.45%) --Total = $.85 cents

I now have my $10.00 to purchase my babies shoes, right? Sort of. I assume I am driving to the store. Assume I am going to need gas. Gotta pay gas taxes, State and Federal on each gallon of gas I buy.

In Texas the State Gas Tax assessed PER gallon (Texas it is $.20)

Federal Gas Tax assessed PER gallon (18.4 cents---round down to $.18)

Assume I need half a gallon of gas--Total Gas taxes would be = $.19

Texas State Sales Tax---8% (give or take depending on your locality) = $.80

Not done yet...Gotta back track a bit.

The shoe was imported. Imported shoes of the type (cheap!) I want to purchase have a Tariff of 48% (unless it came from Mexico or Canada---NAFTA). I am going to round to 50% to make the math a little easier.

Assume the shoe had an assessed value of $4.00 at the point of import at Customs. The Federal Tariff would be $2.00 (50% of $4.00). The importer of the shoe would now have that shoe for a total cost of $6.00. They might add a dollar for good measure and sell it to the retailer you are purchasing it from for $7.00. They in turn sell it to you for $10.00.

So, how much in various taxes have you paid on your way to purchasing a $10.00 pair of shoes.

Tariff----$2.00

Payroll taxes--$.85

Gas Taxes--$.19

Sales Tax---$.80

Total: $3.84 in taxes that I had to encounter in order to get the shoes. That is an effective tax rate of 38.4% on the $10.00 purchase. I did not include any Federal Income Tax on the income. The purchaser could subject to no income tax or a high tax. I just let that go. I also am missing other taxes embedded in the price of the good, other than the tariff, that the retailer pays too. Never ends, it seems. The effective rate is probably higher.

I am not a math person. Tell me where I am going wrong. I am a willing learner. Thanks!

The point of this posting is this tariff of nearly 50% is regressive and hurts the poor. There is no domestic industry to protect from foreign competition. Those are LONG gone, but the tariff remains. If Congress and the President wanted to help the poor, this is easy pickings for repeal.

Why don't they do it???

Thank you for visiting my blog. I post things I think will be of interest to high school students and teachers of economics/government/civics etc. Please leave a comment if what you find here has been useful to you. THANK YOU!

Saturday, November 24, 2012

Average hourly wages for large retailers. How accurate are they??

I have not worked retail in quite some time. I would appreciate anyone seeing this and have worked for any of these companies (or in similar one) confirming these numbers are about right or if they are high or low. From the source, it seems these are "average hourly wages", so new-hires to experienced workers wages are included. Just curious as to how accurate these are. Thanks!

|

| Source: Quartz |

Wednesday, November 21, 2012

My Black Friday piece of Advice, Dos Equis-Style...

I've got too much free time on my hands...

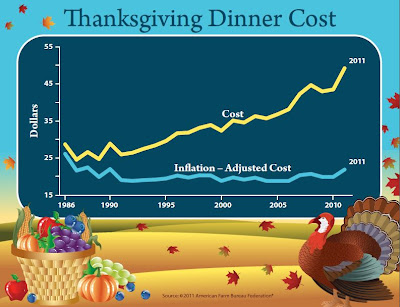

A Thanksgiving Day meal costs 71% more compared to 1986 but it takes the average worker TODAY 45 minutes less to earn the money for that meal. This must mean we are better off, right?

Have to give an economics twist on the holiday. A requirement for an Econ teacher.

Here are a couple of graphics from The Conversable Economist.

The first shows, in inflation adjusted dollars, the change in cost of a shopping basket (literally) of some typical food items needed to prepare a Thanksgiving meal. Not inclusive of everything, but a representation.

Look at the blue line. Pretty flat over time, with a pretty big dip on the left and an up turn on the right. This means, after adjusting for inflation, the cost of this basket of goods has remained fairly consistent. Ok, that is good news, I suppose.

But what about the average consumers ABILITY to purchase these goods in any given year?

One measure is to look at how many hours of work, given a persons wage, does it take to purchase this market basket of goodies.

In 1986 the nominal average hourly wage was $8.94 (average for the year--Data HERE--BEFORE TAXES). So in 1986 a worker had to work ($28.74 / $8.94) 3 hours and 15 minutes to pay for the market basket.(the prices for each years market basket are below)

In 2011 the nominal average hourly wage was $19.46 (before taxes). In 2011 a worker had to work ($49.20 / $19.46) 2 hours and 32 minutes to pay for the same market basket.

The average worker today worked 45 minutes less to earn the money for Thanksgiving dinner than he/she did in 1986.

Variables to consider: If taxes and/or other deductions are higher today than the nominal wage would certainly be lower, hence take more time to purchase the market basket. Are the quality of the goods in the basket better, worse, the same? What else am I missing? Start a list...

Here are a couple of graphics from The Conversable Economist.

The first shows, in inflation adjusted dollars, the change in cost of a shopping basket (literally) of some typical food items needed to prepare a Thanksgiving meal. Not inclusive of everything, but a representation.

|

| Source: The Farm Bureau Federation via The Conversable Economist |

But what about the average consumers ABILITY to purchase these goods in any given year?

One measure is to look at how many hours of work, given a persons wage, does it take to purchase this market basket of goodies.

In 1986 the nominal average hourly wage was $8.94 (average for the year--Data HERE--BEFORE TAXES). So in 1986 a worker had to work ($28.74 / $8.94) 3 hours and 15 minutes to pay for the market basket.(the prices for each years market basket are below)

In 2011 the nominal average hourly wage was $19.46 (before taxes). In 2011 a worker had to work ($49.20 / $19.46) 2 hours and 32 minutes to pay for the same market basket.

The average worker today worked 45 minutes less to earn the money for Thanksgiving dinner than he/she did in 1986.

Variables to consider: If taxes and/or other deductions are higher today than the nominal wage would certainly be lower, hence take more time to purchase the market basket. Are the quality of the goods in the basket better, worse, the same? What else am I missing? Start a list...

|

| Source: Farm Bureau Federation |

Monday, November 19, 2012

"Manufacturing Is ALIVE and Manufacturing jobs are DEAD!!" Not a winning campaign slogan, but it is the truth...

Well, mostly true. A new report Manufacturing the future: The next era of global growth and innovation is circulating on the econ blogoshere and it speaks of the divergence in manufacturing output relative to manufacturing employment.

IMPORTANT NOTE: This report is on GLOBAL manufacturing, NOT just the US!

Note 3 things in the graphic below. Employment in manufacturing in 2006 was only 14% of jobs in the private sector. Private Sector R&D in manufacturing is very high relative to other sectors, but I assume these would not be blue collar "on the assembly line" jobs. Employment in manufacturing from 1996-2006 shows a net loss relative to other sectors.

The "old" manufacturing model was how does/do management and white collar workers assist the line worker in producing the best product.

Going forward the new mantra will be how does/do management and white collar workers assist the machines/robots/ technologically advanced production lines in producing the best product.

Notice the line workers job missing in the second part?

The future....

IMPORTANT NOTE: This report is on GLOBAL manufacturing, NOT just the US!

Note 3 things in the graphic below. Employment in manufacturing in 2006 was only 14% of jobs in the private sector. Private Sector R&D in manufacturing is very high relative to other sectors, but I assume these would not be blue collar "on the assembly line" jobs. Employment in manufacturing from 1996-2006 shows a net loss relative to other sectors.

The "old" manufacturing model was how does/do management and white collar workers assist the line worker in producing the best product.

Going forward the new mantra will be how does/do management and white collar workers assist the machines/robots/ technologically advanced production lines in producing the best product.

Notice the line workers job missing in the second part?

The future....

Read here how Seattle re-invented itself as the high tech hub it is famous for. Oh, wait, what? It did not do ANYTHING? Ok, then they should AT LEAST reimburse Bill Gates for the U-haul rental that made it possible...

Decaying cities looking to revitalize often make pilmages to successful cities to learn how "they did it" and to see if they can copy that success at home.

Often there is no "they did it" at all. It was luck and spontanaiety.

Seattle is a nice example. Seattle was not always the clean, high tech, progressive, shining city on the hill that we all know and love today:

Adam Smith put it this way (emphasis on the last sentence):

Note: I heard this story from a podcast at EconTalk. If you need something to listen to on long walks or a jog/run I recommend there podcasts. Each last about an hour. The Host, Russ Roberts, comes from the Libertarian-leaning point of view but he often has guests on the "other side".

Often there is no "they did it" at all. It was luck and spontanaiety.

Seattle is a nice example. Seattle was not always the clean, high tech, progressive, shining city on the hill that we all know and love today:

"...But in the late 1970s, Seattle was in very different conditions. Seattle as an economy was heavily focused on traditional manufacturing, and services for lumbers and [?] industries. As you can imagine, in the 1970s, these were not great industries to have. The only innovative part of their economy was Boeing. But Boeing was struggling in the late 1970s, laying off people by the thousands. So the economy was in really poor shape, and people were leaving the city by the thousands..." (Source: EconTalk)So, what did the governing Fathers (and Mothers) of the city do to re-rev its engines? Well, nothing, to be exact:

"...But there's something that happened that changed the history of the city forever, and it has to do with Microsoft. Microsoft was not founded in Seattle. At the time it was in Albuquerque, New Mexico. Albuquerque at the time was more high tech than Seattle. And in fact the main reason Microsoft was there was that their first client was there. Microsoft stayed there for four years and was doing fine, was prospering. But in 1979, Bill Gates and Paul Allen, the founders, decided that they wanted to be close to their families--who were in Seattle. So they relocated the company back to Seattle. Now, at the time this was a small company, 15 employees. And nobody really paid attention to this move. But in retrospect, that was the seed that was responsible for the growth of the high tech sector in Seattle and the complete reshaping of the local economy, and the rebirth of the city both economically, culturally, and in terms of amenities...."(Source: EconTalk)So, a fateful decision by 2 young entrepreneurs who had an idea, ambition and just wanted to be closer to home, saved a city and revitalized a region.

Adam Smith put it this way (emphasis on the last sentence):

“Every individual is continually exerting himself to find out the most advantageous employment for whatever capital he can command. It is his own advantage, indeed, and not that of the society which he has in view. But the study of his own advantage naturally, or rather necessarily, leads him to prefer that employment which is most advantageous to society... He intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was not part of his intention” ― Adam Smith, An Inquiry into the Nature & Causes of the Wealth of Nations, Vol 1Or dumb luck. Either one. :)

Note: I heard this story from a podcast at EconTalk. If you need something to listen to on long walks or a jog/run I recommend there podcasts. Each last about an hour. The Host, Russ Roberts, comes from the Libertarian-leaning point of view but he often has guests on the "other side".

Great links to Vintage online catalogs from yesteryear. How much fun is this!!!

Mark Perry at Carpe Diem has the following links to vintage catalogs that are online and you can view them by flipping pages just like the old days.

Great resource for teachers and students as a primary source for fashion, culture and technology.

How much fun it is to look through these and see how much has changed. I had fogotten some of the products and fashions!

1. Wishbook Web, the “vintage Christmas catalog archive project,” with online versions of old Christmas catalogs (Sears, Wards, J.C. Penny, FAO Schwarz, etc.) from 1933 to through 1988.

2. Online Radio Shack Catalog Archive, back to 1939.

3. Online Radio Shack Computer Catalogs, back to 1977.

Great resource for teachers and students as a primary source for fashion, culture and technology.

How much fun it is to look through these and see how much has changed. I had fogotten some of the products and fashions!

1. Wishbook Web, the “vintage Christmas catalog archive project,” with online versions of old Christmas catalogs (Sears, Wards, J.C. Penny, FAO Schwarz, etc.) from 1933 to through 1988.

2. Online Radio Shack Catalog Archive, back to 1939.

3. Online Radio Shack Computer Catalogs, back to 1977.

Why we can't have nice things. One graphic that will show you why Government "Investment" in infrastructure is almost impossible to come by these days.

The spending side of the Federal Budget is the sum of two major categories that spending can be slotted into: Mandatory Spending ("Non-Discretionary"--must happen under the law per previous legislation) and Non-Mandatory ("Discretionary"---can happen, or not happen, with active legislation).

Mandatory spending occurs on things that are required when: (1) recipients meet eligibility requirements, such as Social Security, Medicare, Medicaid, and/or (2) "automatic stabilizers" like employment compensation, food and housing kick in as the state of the economy changes (i.e. recession).

Non-Mandatory ("Discretionary") spending is spending on "everything else". You could term it government "investment"---roads, bridges, infrastructure, science, space exploration, education, Big Bird, on and on...You know, the fun stuff and stuff that complements and enhances private investment. What economists call "Public Goods".

Using historical tables from the Office of Management and Budget (OMB), I cropped the most significant mandatory spending budget items for the years 1967 and 2012 and calculated the percent each budget category was/is relative to the total budget of the respective year. I use 1967 because it is the first year of the Medicare program (federal payments for the health care of retirees).

Keep in mind, the numbers you see below are in "millions". So for instance, in 1967 the total spending on Mandatory and Non-Mandatory budget items was $157,467 millions (see number at the bottom), or a little over $157 Billion dollars. In 2012 the total is 3,595,422 million or almost $3.6 Trillion.

In 1967, 32% of the Federal spending was on Mandatory items in the budget. That means 68% could be spent on the "Public Goods" mentioned above.

Fast forward...In 2012, 63% of the Federal spending is on Mandatory items. That means only 37% left to spend on Public Goods/Government Investment in stuff.

That is quite a reversal of fortunes in the last 45 years.

Can you see now why it is difficult to have any new "public goods" toys?

Mandatory spending occurs on things that are required when: (1) recipients meet eligibility requirements, such as Social Security, Medicare, Medicaid, and/or (2) "automatic stabilizers" like employment compensation, food and housing kick in as the state of the economy changes (i.e. recession).

Non-Mandatory ("Discretionary") spending is spending on "everything else". You could term it government "investment"---roads, bridges, infrastructure, science, space exploration, education, Big Bird, on and on...You know, the fun stuff and stuff that complements and enhances private investment. What economists call "Public Goods".

Using historical tables from the Office of Management and Budget (OMB), I cropped the most significant mandatory spending budget items for the years 1967 and 2012 and calculated the percent each budget category was/is relative to the total budget of the respective year. I use 1967 because it is the first year of the Medicare program (federal payments for the health care of retirees).

Keep in mind, the numbers you see below are in "millions". So for instance, in 1967 the total spending on Mandatory and Non-Mandatory budget items was $157,467 millions (see number at the bottom), or a little over $157 Billion dollars. In 2012 the total is 3,595,422 million or almost $3.6 Trillion.

In 1967, 32% of the Federal spending was on Mandatory items in the budget. That means 68% could be spent on the "Public Goods" mentioned above.

Fast forward...In 2012, 63% of the Federal spending is on Mandatory items. That means only 37% left to spend on Public Goods/Government Investment in stuff.

That is quite a reversal of fortunes in the last 45 years.

Can you see now why it is difficult to have any new "public goods" toys?

Note: Numbers may not add up because I rounded AND I cut lots of categories to include only the essential budget items.

Subscribe to:

Comments (Atom)