In AP Microeconomics one of the types of market structures we study is of firms that operate in a "Perfectly Competitive" market. This means: (1) there are many producers, (2) they produce an identical product, (3) there is easy entry and exit from the market, (4) low barriers to entry into the market, (4) the firm is a "price taker". Each individual farmer has no control over the price they receive for what they produce.

Farmers in the agricultural industry are the best (and closest) example to illustrate a Perfectly Competitive Market.

In the article excerpted below

(Bloomberg) a farmer is looking at the price he can receive for growing either corn or soybeans ("Price Taker"). His land is suitable for producing either corn or soybeans ("easy exit from corn, easy entry into soybeans") and it is not costly to switch from one to the other (low barrier of entry--he has the equipment and know-how to grow either).

He has no particular love for either crop. He is simply measuring what he can receive for each acre planted and harvested against the his cost of planting and harvesting each acre. The difference is his profit per acre.

This is a great article for teachers and students to show with the two graphs necessary to analyze the perfectly competitive market: The Firm Graph and the Market Graph. Both are taken into consideration here.

Soybean Switch on U.S. Corn Farms Expanding World Surplus

Corn is no longer king on Todd Wachtel’s 5,500-acre farm inIllinois. After prices fell to a three-year low in January, he will cut planting by 20 percent in 2014 and devote half his land to soybeans, which are cheaper to grow and just as profitable for the first time in four years.

Across the Corn Belt, growing the biggest U.S. crop had been an easy choice for farmers since 2009. Annual revenue was $150 per acre more than soybeans on average for Wachtel, who sowed 3,450 acres of corn in 2013, or 63 percent of his land. This year, lower prices mean both crops will earn $10 to $20 an acre, so Wachtel is reducing his risk by sowing more soybeans, which cost $220 less per acre to grow than corn.

“You are putting less money at risk for the same profit,” Wachtel, 42, said by telephone from Altamont, about 220 miles (354 kilometers) south of Chicago.

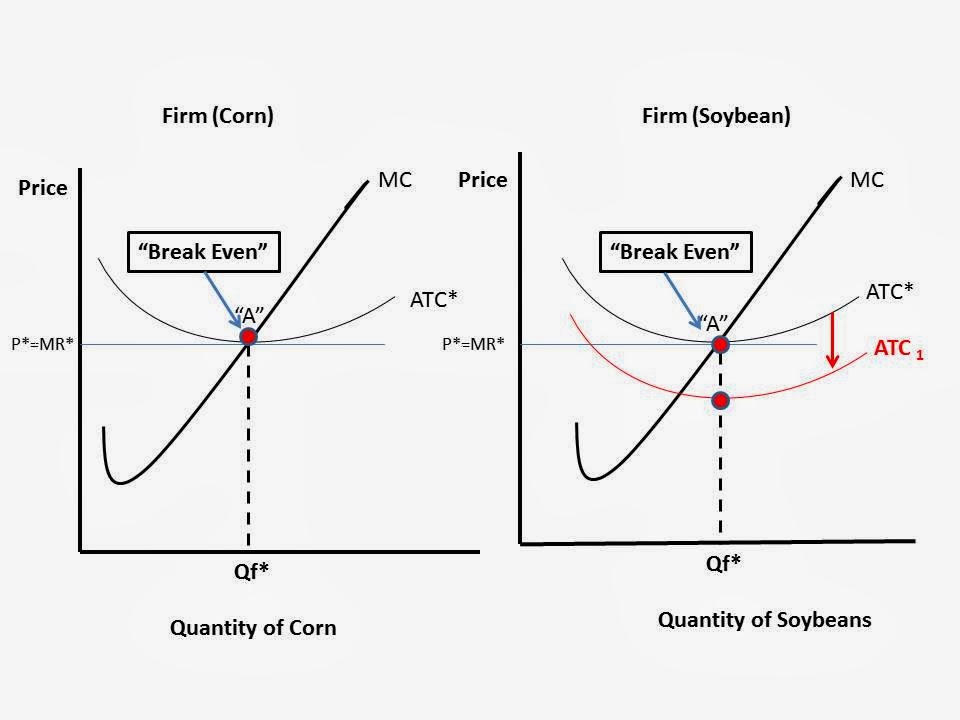

Here are the firm graphs I made to illustrate what is happening. For simplicity, I am assuming all cost associated with the switch are "Fixed Costs" and will only affect the Average Total Cost ("ATC") of producing. I did not want to shift the Marginal Cost curve too because it complicates things. If I did it would show the MC curve shifting to the RIGHT and the Quantity of Soybeans would increase, just as the article states.

The Price the farmer receives is the same for either crop (as mentioned in the article) at "P*=MR*) but his cost of producing soybeans is LESS than the cost of producing Corn per acre.

Ceterus Paribus, the ATC curve for soybeans shifts DOWN and the farmer is now making some economic profits in soybeans as compared to "Breaking Even" when he produces Corn.