We buy $4 worth of stuff from China and they buy $2 worth of stuff from the US (does not matter what the "stuff" is and I just made up this 2 to 1 ratio). After the transaction there is $2 left over and it is in Chinese hands. What to do with these $2? The Chinese are notorious savers. They save about 50% of their money and they like safe investments. They buy $1 worth of US Treasuries---sure, the interest rate is low but is a very safe place to put money relative to just about ANY other investment on earth. Congress uses this money to fund programs, fight wars, etc. The program is fully funded (Some Taxpayer money PLUS lots of borrowed money) at the cost of paying only the interest. What a deal! We gets lots of benefits at the cost of a combination of some taxes and some interest...Rinse and repeat until we get 43% of our public debt owed to "Foreign Governments and/or Individuals"--

In a nutshell---The US has been asking others to fund programs our political leaders do not/did not have the courage to ask us to pay for ourselves. They do not even have to consider very closely the merits of those programs, finding funding sources has been relatively easy. Whose fault is this? I think you already know the answer...

Thank you for visiting my blog. I post things I think will be of interest to high school students and teachers of economics/government/civics etc. Please leave a comment if what you find here has been useful to you. THANK YOU!

Friday, July 29, 2011

The latest Big Mac Index is out...See how much it costs around the world...

The latest Big Mac Index from The Economist is out. At current (July 2011) exchange rates you can see how much in US dollars it takes to buy McDonald's signature sandwich in various countries around the world---look at the column to the right. The horizontal bars indicate in percentage terms how much that countries currency is overvalued or undervalued relative to Purchasing Power Parity (PPP). PPP suggests that in the "long run" the ACTUAL published market exchange rate between two currencies (say, the Norwegian Krone at $1.00 = 5.41 Kroners--July 28th) should equal the ratio of the price of a Big Mac in Krones divided by the price of a Big Mac in Dollars (45 Kroners/$4.07 = 11.06). At PPP we would get 11.06 Kroners for each dollar exchanged, but at real world rates we are getting only 5.41 Kroners. We are paying a little over double the suggested PPP exchange rate, hence the blue bar (calculate percentage change--PPP exchange rate minus the Actual exchange rate divided by the Actual exchange rate times 100) and the implication that the Krone is OVERVALUED (+) relative to the dollar.

The Big Mac is only one product sold in each of the countries and there are many factors that effect exchange rates. A fun exercise would be to find another closely related good and do a similar comparison. Sounds like a homework project to me...

The Big Mac is only one product sold in each of the countries and there are many factors that effect exchange rates. A fun exercise would be to find another closely related good and do a similar comparison. Sounds like a homework project to me...

Thursday, July 28, 2011

Tired of the Fear-Mongering on BOTH sides in the Debt talk and what a downgrade in the US credit rating MIGHT mean? Come join me in the center for an alternative view. I actually use some history. Novel concept...

This first graph shows previous situations where a nations bond rating (developed/rich countries) has been lowered (see the notes at the bottom of the graph) and the effect on interest rate the nation must pay to borrow money. It shows the period before and after downgrade.

The vertical bar in the middle represents "D-Day" for debt downgrade. On the left are days prior and on the right days after. The vertical axis measures "bp" or "basis points". A basis point represents a 1/100 of 1 or .01 and it refers to interest rates. For example, 1% interest rate is 100 basis points, 2% is 100 bp, and so on. If the interest rate increases to 1.50% we say the interest rate increased by 50 basis points. The horizontal line represents a composite average of all the nations bond interest rates. Any basis point above or below the line represents a change from that average. What do you notice about the 11 days prior and 11 days after downgrade? The 19 days before and 19 days after?

Look at the perfomance of the US 10 Year Treasury Note (the benchmark for all the discussion) since 1990 in the graph below (I generated this from the US Treasury Website). Just eyeballing it, I would have to say we are WAY below average rates historically on the 10 Year Note. In other words, if we made a graph for the US like the one above, to the left of the Day 0, we would be significantly below average in basis points. The Federal govt has been able to borrow money at VERY low interest rates for some time now.

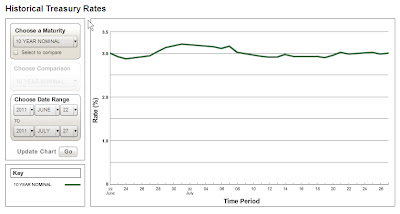

Here is the perfomance of the US 10 Year Treaury Note in the LAST MONTH (June 27-July 27):

Does this look like a bond market anticipating turmoil? In the first graph, you can see there was some trepidation in advance of downgrade but it quickly resolved itself.

Not to suggest nothing will happen on our D-Day, but I have watched politicians and the media the last few days with frustration. I feel like they have us caught in Socrates Cave and we are just watching the shadows on the wall. I REALLY want to turn around and see the light!!

The vertical bar in the middle represents "D-Day" for debt downgrade. On the left are days prior and on the right days after. The vertical axis measures "bp" or "basis points". A basis point represents a 1/100 of 1 or .01 and it refers to interest rates. For example, 1% interest rate is 100 basis points, 2% is 100 bp, and so on. If the interest rate increases to 1.50% we say the interest rate increased by 50 basis points. The horizontal line represents a composite average of all the nations bond interest rates. Any basis point above or below the line represents a change from that average. What do you notice about the 11 days prior and 11 days after downgrade? The 19 days before and 19 days after?

|

| Source: Stonestreetadvisors |

|

| Source: US Treasury |

|

| Sourced: US Treasury |

Not to suggest nothing will happen on our D-Day, but I have watched politicians and the media the last few days with frustration. I feel like they have us caught in Socrates Cave and we are just watching the shadows on the wall. I REALLY want to turn around and see the light!!

"""A prisoner is freed from his bonds, and is forced to look at the fire and at the statues themselves. After an initial period of pain and confusion because of direct exposure of his eyes to the light of the fire, the prisoner realizes that what he sees now are things more real than the shadows he has always taken to be reality. He grasps how the fire and the statues together cause the shadows, which are copies of these more real things. He accepts the statues and fire as the most real things in the world. This stage in the cave represents belief. He has made contact with real things—the statues—but he is not aware that there are things of greater reality—a world beyond his cave."" Sparknotes

Wednesday, July 27, 2011

Another thing we don't learn in history class, but is interesting to know about...

See if you can identify who this famous historical figure is in this photo taken when they were about 7 years old...CLICK HERE FOR THE ANSWER....

Tuesday, July 26, 2011

Just did a comparison between the growth of Texas State Employment and Federal Employment during the Recession. What is my conclusion? We have a President named Rick Obama and a Governor named Barack Perry...

I used US Census data to get these numbers. Click on the numbers to go to the specific Census page with the data. At BOTH levels of government employment increased DURING the recession. NOW I am confused as to who is the "Big Government Liberal"...

Texas 2009 265,310

Texas 2007 259,578

State Employees INCREASED by 5,732 or +2.2%

The percentage of State Employees to the population of Texas is (265,310/24,782,302) = 1.07%

Federal 2009 2,823,777

Federal 2007 2,730,050

Federal Employees INCREASED by 93,727 or +3.4%

The percentage of Federal Employees to US population is (2,823,777/310,000,000) = .91%.

Texas 2009 265,310

Texas 2007 259,578

State Employees INCREASED by 5,732 or +2.2%

The percentage of State Employees to the population of Texas is (265,310/24,782,302) = 1.07%

Federal 2009 2,823,777

Federal 2007 2,730,050

Federal Employees INCREASED by 93,727 or +3.4%

The percentage of Federal Employees to US population is (2,823,777/310,000,000) = .91%.

College and Cigarettes---What do they have in common? You smoke one (but DON'T!) and the other smokes you (well, at least your wallet)...

Well, they both burn though your money--one figuratively and one literally. Since 1970 the cost of attending higher education has increased 1,000%, medical care approx 550%, housing approx 420% and the price level of ALL things measured in the Consumer Price Index (including the items already mentioned) approx 375%. Do you ever ask yourself WHY college, overtime, has increased in price much more relative to ANYTHING else in the economy? Opps, an exception below...

Cigarettes and tobacco products have increased more. We know that is because taxes have increased on those products significantly. Higher education is not heavily tax, BUT it is heavily subsidized. It that the root of the problem? We all know how much we PAY for college, but I believe no one knows how much it actually COSTS. Those are two different concepts.

|

| Source: Carpe Diem |

Cigarettes and tobacco products have increased more. We know that is because taxes have increased on those products significantly. Higher education is not heavily tax, BUT it is heavily subsidized. It that the root of the problem? We all know how much we PAY for college, but I believe no one knows how much it actually COSTS. Those are two different concepts.

Nice graphic showing how much of your pay each day goes to paying taxes and how long you have to work to pay those taxes. You won't look at each minute of the working day the same after this...

Another National Debt Interactive---I never tire of these..We MUST be informed on this issue...

Go HERE for a more clear image and interactivity...

|

| Source: Congressional Quarterly |

Treasury securities are the most sought-after in the world because the assumption that United States would always be able to repay its debts has generally gone unquestioned. That is why officials are negotiating to increase the government’s borrowing limit and avoid a default.

More than $9 trillion of the total debt is held by “the public” — a broad category that includes individual investors in the United States and overseas, the Federal Reserve system, and foreign governments and central banks. The remaining debt is held by government accounts, mostly trust funds established to collect dedicated revenue to pay for such programs as Social Security, Medicare and highway construction.

Almost all of the debt held by the public is “marketable,” meaning that those securities are bought and sold in financial markets. The debt held by the Fed is part of those marketable holdings. So is the debt held by China, the largest foreign creditor at $1.1 trillion. Japan is a close second at $900 billion. Domestic investors — from mutual funds to institutions, such as pensions, to individuals — hold $3.2 trillion in marketable debt and a small share of the non-marketable debt, particularly savings bonds.

Notes

Countries listed under "foreign investors" indicate where Treasury securities are held. That does not mean that citizens, governments or central banks of that country own the securities. They may actually be owned by citizens or institutions from third countries that used the listed country for the purchase transaction.

Airlines are currently NOT collecting Federal Taxes on tickets you purchase. The price of your ticket should decrease by the amount of the tax, RIGHT? HA! Let me 'splain' to you what is happening---My graphs included for no charge---or tax.

Because Congress did not fully fund the Federal Aviation Administration (FAA) in a bill last week, the FAA is NOT collecting some taxes that are levied on your purchase of a plane ticket. WOW! I guess that means the ticket price SHOULD decrease, right? Not so fast:

U.S. airlines raise fares as taxes lapse

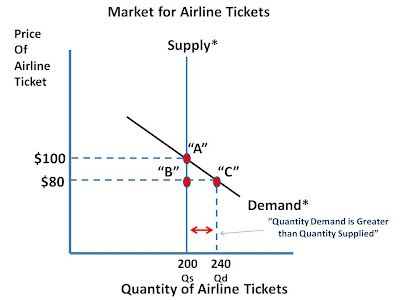

Let's look at this graphically. Assumptions: We look at one plane only with 200 seats. No matter what the price, there are only 200 seats REGARDLESS of what the price of the ticket is. Supply of tickets is Perfectly INELASTIC. The price of the ticket for the customer is $100 (see 1st graph) which includes the taxes levied BEFORE the latest event happened.

Assume the taxes submitted to the govt totals $20 of the $100 final ticket price. So, the price the airline actually receives for the flight is $80 ("Point B". This is illustrated in the graph below.

Without the $20 in taxes included in the ticket, the market price of the ticket SHOULD drop to $80 (Point "C"). Because the price of the ticket DECREASED ("ceterus paribus") we move ALONG the existing demand curve, downward and to the right to Point "C". According to our market demand curve ("Demand*") at $80 the QUANTITY DEMANDED is 240 seats. We can see that the QUANTITY SUPPLIED of seats is still 200. Our market is in dis-equilibrium where Quantity Demanded is GREATER than Quantity Supplied---we have a SHORTAGE of seats

It is clear that the market clearing price is $100 (Ceterus Paribus--assuming DEMAND does not increase or decrease). The quantity demanded will decrease as the price increases to clear the market and ration the 200 seats.

Yes, theoretically 40 people will be rationed off the plane as we move back to the previous market equilibrium price of $100 and 200 seats:

U.S. airlines raise fares as taxes lapse

Many U.S. airlines have raised fares in recent days to take advantage of a lapse in U.S. ticket tax collection after Congress failed last week to fully fund the Federal Aviation Administration budget, but passengers are not likely to notice any price difference.

The expiration of the FAA reauthorization on Friday means some aviation taxes are no longer being collected. These include a 7.5 percent sales tax on U.S. air transportation and a 7.5 percent sales tax on the purchase of air miles, said fare watcher FareCompare.com. Additionally, taxes on jet fuel are also reduced.

"Friday evening we adjusted prices so the bottom line price of a ticket remains the same as it was before prior to the expiration of federal excise taxes, etc.," American Airlines (AMR.N) spokesman Tim Smith said by email.

Let's look at this graphically. Assumptions: We look at one plane only with 200 seats. No matter what the price, there are only 200 seats REGARDLESS of what the price of the ticket is. Supply of tickets is Perfectly INELASTIC. The price of the ticket for the customer is $100 (see 1st graph) which includes the taxes levied BEFORE the latest event happened.

Assume the taxes submitted to the govt totals $20 of the $100 final ticket price. So, the price the airline actually receives for the flight is $80 ("Point B". This is illustrated in the graph below.

Without the $20 in taxes included in the ticket, the market price of the ticket SHOULD drop to $80 (Point "C"). Because the price of the ticket DECREASED ("ceterus paribus") we move ALONG the existing demand curve, downward and to the right to Point "C". According to our market demand curve ("Demand*") at $80 the QUANTITY DEMANDED is 240 seats. We can see that the QUANTITY SUPPLIED of seats is still 200. Our market is in dis-equilibrium where Quantity Demanded is GREATER than Quantity Supplied---we have a SHORTAGE of seats

It is clear that the market clearing price is $100 (Ceterus Paribus--assuming DEMAND does not increase or decrease). The quantity demanded will decrease as the price increases to clear the market and ration the 200 seats.

Yes, theoretically 40 people will be rationed off the plane as we move back to the previous market equilibrium price of $100 and 200 seats:

The key difference is that the airline is the beneficiary of this lapse in policy. In the short term, they reap an additional $20 per ticket. In economic terms, they are earning some "economic profits", profits over and above "normal profits"--Total Revenues - Total Costs (fixed costs + variable costs + opportunity costs).

We SHOULD expect competition to take care of these economic profits. The presence of economic profits sends a signal to the market that more seats are needed. An additional plane will be called into service and the SUPPLY of Airline Seats will INCREASE. The supply curve will shift to the right and the market price will decease to $80--the price of assumed "normal profits"...

Again, I made lots of simplifying assumptions, but overall this how the process works. I hope this helps you understand microeconomics a little better. :)

Monday, July 25, 2011

Texts Messages, Amazon, Netflix, and I-Tunes are responsible for Income Inequality in the US. This is what I see in this Infrographic...Can you see it too?

How the "creative" advancement and market implementation of technology has "destroyed" industries over time. Old jobs destroyed (that's gotta hurt some people) and new jobs emerge (probably not jobs that the first group can perform)---this in a nutshell gives insight into the problem of rising income inequality in the US. Think about the skills required to perform the jobs in each of the compared industries below... It is not the whole story, but there is a link...

|

Source: Chartporn

|

Creative use of Production Possibilities Frontier in regards to heathcare outcomes vs cost between the US and Canada. Regardless of how you feel about the issue, this is informative...

I hesitate to call this a Production Possibilities Frontier (the authors of this study do) because it looks different than the one we use in introductory economics. Appears to me to be somewhat of a supply curve with the output ("Health") on the vertical axis and the inputs ("Resources"--which have a price/cost) on the horizontal axis. But they are smarter than me, so lets go with it. It is a nice illustration of Allocative and Productive Efficiency as applied to health care.

The curve is upward sloping indicating that as we add resources (move to the right from the origin on the horizontal axis) we get positive health outcomes (move up from the origin on the vertical axis). The curve is steep at first, indicating that as more resources are added the returns to health outcomes increase faster relative to the added inputs---Increasing Marginal Returns(see definition). It then flattens out, indicating that as more resources are added the returns to health outcomes start to decrease---Decreasing Marginal Returns (see definition).

There are 3 points identified on the graph "Canada", "Ideal US" and "Actual US". The horizontal difference between "Canada" and "Actual US" is labeled "Allocative (in)Efficiency". This means that to get the SAME health outcomes (point of Vertical axis) as Canada, the US uses more resources to do so---identified with the brackets and labeled "Allocative (in) Efficiency". Resources have a dollar cost, hence to get the same health outcomes as Canada we spend more total dollars. Allocative Efficiency is achieved when the value consumers place on a good or service (reflected in the price they are willing to pay) equals the cost of the resources used up in production. Condition required is that price = marginal cost. When this condition is satisfied, total economic welfare is maximised."". All things equal, the price of heath care in the US is more expensive than comparable health care in Canada.

Going in the other direction from "Actual US" to "Ideal US", the gap represented by the bracket shows "Productive (in)Efficiency". Given the resources we allocate to health care we SHOULD be getting more/better health care output/outcomes. This is measured by going from "Ideal US" to a point on the vertical axis. We know we are not getting this level of health care outcomes given the resources used, so we are being productively inefficient in the delivery of health care. Productive Efficiency is achieved when the output is produced at minimum average total cost (AC). For example we might consider whether a business is producing close to the low point of its long run average total cost curve. When this happens the firm is exploiting most of the available economies of scale. Productive efficiency exists when producers minimise the wastage of resources in their production processes.

This graph accompanies a very interesting study (link above) on one of the reasons health care costs are high in the US. The focus is on the administrative costs of delivering health care in the US relative to other countries. Regardless of how you feel about the issue, I encourage you to read the whole thing. We gotta get real if we want to control the cost of health care now and in the future....

HT: The Conversable Economist

|

| Source: David M. Cutler and Dan P. Ly write of "The (Paper)Work of Medicine: Understanding International Medical Costs." |

There are 3 points identified on the graph "Canada", "Ideal US" and "Actual US". The horizontal difference between "Canada" and "Actual US" is labeled "Allocative (in)Efficiency". This means that to get the SAME health outcomes (point of Vertical axis) as Canada, the US uses more resources to do so---identified with the brackets and labeled "Allocative (in) Efficiency". Resources have a dollar cost, hence to get the same health outcomes as Canada we spend more total dollars. Allocative Efficiency is achieved when the value consumers place on a good or service (reflected in the price they are willing to pay) equals the cost of the resources used up in production. Condition required is that price = marginal cost. When this condition is satisfied, total economic welfare is maximised."". All things equal, the price of heath care in the US is more expensive than comparable health care in Canada.

Going in the other direction from "Actual US" to "Ideal US", the gap represented by the bracket shows "Productive (in)Efficiency". Given the resources we allocate to health care we SHOULD be getting more/better health care output/outcomes. This is measured by going from "Ideal US" to a point on the vertical axis. We know we are not getting this level of health care outcomes given the resources used, so we are being productively inefficient in the delivery of health care. Productive Efficiency is achieved when the output is produced at minimum average total cost (AC). For example we might consider whether a business is producing close to the low point of its long run average total cost curve. When this happens the firm is exploiting most of the available economies of scale. Productive efficiency exists when producers minimise the wastage of resources in their production processes.

This graph accompanies a very interesting study (link above) on one of the reasons health care costs are high in the US. The focus is on the administrative costs of delivering health care in the US relative to other countries. Regardless of how you feel about the issue, I encourage you to read the whole thing. We gotta get real if we want to control the cost of health care now and in the future....

HT: The Conversable Economist

Nice interview with Bill Gates on energy and the environment---He even uses the term Opportunity Costs...NICE!!!

In a discussion on energy, Mr Gates invokes the important economic term "Opportunity Cost". He uses it terms of using land to produce food for either human consumption or energy production. Trying to solve one problem (clean energy) creates unintended consequences (well, dead people from starvation/malnutrition). I encourage you to read the whole interview (rather short). He has some good insights and touches on many behavorial economic concepts as well the state of alternative energy on a macro and micro level.

Q&A: Bill Gates on the World Energy Crisis

Q&A: Bill Gates on the World Energy Crisis

Anderson: When you look at the big picture, where should we be focusing besides nuclear? On massive solar plants in the desert? On middle-size stuff for office roofs? Or is there a reinvention that could be done right in the home?

Gates: If you’re going for cuteness, the stuff in the home is the place to go. It’s really kind of cool to have solar panels on your roof. But if you’re really interested in the energy problem, it’s those big things in the desert.

Rich countries can afford to overpay for things. We can afford to overpay for medicine, we can overpay for energy, we can rig our food prices and overpay for cotton. But in the world where 80 percent of Earth’s population lives, energy is going to be bought where it’s economical. People are going to buy cheap fertilizer so they can grow enough crops to feed themselves, which will be increasingly difficult with climate change.

You have to help the rest of the world get energy at a reasonable price to get anywhere. It’s great to have the rich world, because we’re there to think about long-term problems and fund the R&D. But we get sloppy, because we’re rich. For example, despite often-heard claims to the contrary, ethanol has nothing to do with reducing CO2; it’s just a form of farm subsidy. If you’re using first-class land for biofuels, then you’re competing with the growing of food. And so you’re actually spiking food prices by moving energy production into agriculture. For rich people, this is OK. For poor people, this is a real problem, because their food budget is an extremely high percentage of their income. As we’re pushing these things, poor people are driven from having adequate food to not having adequate food.

The most interesting biofuel efforts avoid using land that’s expensive and has high opportunity costs. They do this by getting onto other types of land, or taking advantage of byproducts that aren’t used in the food chain today, or by intercropping....""

The whole article is HERE...

Sunday, July 24, 2011

Very short lesson on what might happen in a few hours in the US Treasury market if a debt deal is not made (or even if one IS made)...

The Federal government borrows money by issuing US Treasury notes/bills---basically IOU's. I am going to use a very simple example to show how the market for US Treasuries may be affected by the failure to raise the debt limit. Keep in mind these numbers are NOT reflective of true market prices. The math is easier for me that way...

If the govt wants to borrow money they issue one of these Treasury Notes/Bills. Assume the face value of this Treasury is $1,000 and the current market price for this Treasury is $900 (remember, this does NOT reflect the REAL market AT ALL!). You buy this bond for $900, so the government in essence has borrowed $900 to spend on whatever they want to spend it on. When you redeem it at maturity you earn $100 over what you paid for it. Your effective interest rate then was 11.11% ($100/$900 x 100).

Now, assume the debt limit is not raised and there is perception/eat that the US govt will default on its debt obligations. What is going to happen to the price of US Treasurys now and in the future? We should expect the price to DECREASE as the Demand for them DECREASES.

Now, for the govt to attract borrowers they will have to LOWER the price of the Treasury to entice people to buy one. Assume the price is now $800 for a $1,000 Treasury. So, now the effective interest rate is 25% ($200/$800 X 100)!!

This is what it means when you hear that the borrowing costs for the US government might increase if a deal is not reached. They will have to accept LESS for each bond issued and pay MORE when they are redeemed.

I hope this helps when the stuff hits the fan in a few hours. The first thing that will be affected will be the price of US Treasuries in the market.

Note: The demand may fall as I described for US Treasuries BUT the Supply of Treasuries already in circulation could (will ) increase as investors dump them. If the supply increases it has the same effect as demand decreasing, hence the same downward pressure on the price and effect on borrowing costs...

If the govt wants to borrow money they issue one of these Treasury Notes/Bills. Assume the face value of this Treasury is $1,000 and the current market price for this Treasury is $900 (remember, this does NOT reflect the REAL market AT ALL!). You buy this bond for $900, so the government in essence has borrowed $900 to spend on whatever they want to spend it on. When you redeem it at maturity you earn $100 over what you paid for it. Your effective interest rate then was 11.11% ($100/$900 x 100).

Now, assume the debt limit is not raised and there is perception/eat that the US govt will default on its debt obligations. What is going to happen to the price of US Treasurys now and in the future? We should expect the price to DECREASE as the Demand for them DECREASES.

Now, for the govt to attract borrowers they will have to LOWER the price of the Treasury to entice people to buy one. Assume the price is now $800 for a $1,000 Treasury. So, now the effective interest rate is 25% ($200/$800 X 100)!!

This is what it means when you hear that the borrowing costs for the US government might increase if a deal is not reached. They will have to accept LESS for each bond issued and pay MORE when they are redeemed.

I hope this helps when the stuff hits the fan in a few hours. The first thing that will be affected will be the price of US Treasuries in the market.

Note: The demand may fall as I described for US Treasuries BUT the Supply of Treasuries already in circulation could (will ) increase as investors dump them. If the supply increases it has the same effect as demand decreasing, hence the same downward pressure on the price and effect on borrowing costs...

My explanation as to why Social Security Checks WILL go out regardless of what happens with the debt limit. Man, we are gullible!!.

When you (and all other workers subjected to payroll taxes) work, 12.40% of whatever you earn goes to the Social Security Trust Fund (you pay 6.2% and your employer pays 6.2%). For years this amount has exceeded what was needed to pay retirees Social Security checks. The difference in what was brought in and paid out was the then "borrowed" by Congress to spend on wars, bridges, tax breaks, whatever...The S.S. Trust Fund took US Treasury Bonds ("IOU's) in exchange for loaning the surplus money to Congress. This is known as an "Intergovernmental Transfer"--government borrowing from itself. The Trust fund has lots of these bonds, roughly $2.5 Trillion (yes, that is right) worth. They can redeem them as needed.

Assume the debt limit of $14.3 Trillion is met with no extension. There have been threats that granny may not receive her Social Security check next month. Let me show you how this is not possible, unless political leaders "choose" (not forced) to do so.

This $2.5T owed to the SS Trust fund is part of the $14.3T national debt accumulated by Congress. If a deal is not reached, EXCLUSIVE of any decision about what to spend or not spend on out of the Federal budget this is what the SS Trust fund can do.

Little less than $60 Billion is paid out in Social Security checks each month. The SS Trust fund CAN "cash in" $60 Billion of the $2.5T in bonds they hold. The US Treasury is required to take those bonds and credit the SS Trust fund with the proceeds. The Trust Fund can now cut checks and granny can go to the bingo parlor with no worries...Because the those bonds have been paid off and they were a part of the $14.3T national debt, the national debt DECREASES by $60 Billion BELOW the debt limit. Now, Congress can borrow $60 billion MORE to meet other obligations and NOT be over the legal debt limit...Rinse and repeat next month...

This is not a long term solution. The first question that comes to mind is WHERE did the US Treasury get the money (or electronic credits) to pay off the bonds? Well, they printed/pressed a button. Inflationary, you say? Perhaps, but inflation is not the biggest problem we face right now. (Yes, this is kicking a can down the road, but just a DIFFERENT can...)...

The Federal budget problems have to be addressed, but they don't have to be at granny's expense.

So, when you hear a politician or a talking head on TV tell you Social Security checks won't go out, they are either not informed or they assume you are not and will believe anything...Don't let it be the latter...

Please read this editorial by Thomas Saving that I base this blog entry on...He is not responsible for any of my misinterpretations of his work... :)

Assume the debt limit of $14.3 Trillion is met with no extension. There have been threats that granny may not receive her Social Security check next month. Let me show you how this is not possible, unless political leaders "choose" (not forced) to do so.

This $2.5T owed to the SS Trust fund is part of the $14.3T national debt accumulated by Congress. If a deal is not reached, EXCLUSIVE of any decision about what to spend or not spend on out of the Federal budget this is what the SS Trust fund can do.

Little less than $60 Billion is paid out in Social Security checks each month. The SS Trust fund CAN "cash in" $60 Billion of the $2.5T in bonds they hold. The US Treasury is required to take those bonds and credit the SS Trust fund with the proceeds. The Trust Fund can now cut checks and granny can go to the bingo parlor with no worries...Because the those bonds have been paid off and they were a part of the $14.3T national debt, the national debt DECREASES by $60 Billion BELOW the debt limit. Now, Congress can borrow $60 billion MORE to meet other obligations and NOT be over the legal debt limit...Rinse and repeat next month...

This is not a long term solution. The first question that comes to mind is WHERE did the US Treasury get the money (or electronic credits) to pay off the bonds? Well, they printed/pressed a button. Inflationary, you say? Perhaps, but inflation is not the biggest problem we face right now. (Yes, this is kicking a can down the road, but just a DIFFERENT can...)...

The Federal budget problems have to be addressed, but they don't have to be at granny's expense.

So, when you hear a politician or a talking head on TV tell you Social Security checks won't go out, they are either not informed or they assume you are not and will believe anything...Don't let it be the latter...

Please read this editorial by Thomas Saving that I base this blog entry on...He is not responsible for any of my misinterpretations of his work... :)

Nice graphics showing the difference in employment levels between Texas and California AND the price of moving trucks/vans between the two states..The signs are everywhere...

I don't know the number of jobs Texas has "stolen" from California, but I am sure there has been somewhat of a zero-sum result in net gain/loss in jobs between the two states. One underlying market sign as to what may be happening is the self-moving truck/van market. From the two graphics I clipped today (July 24th) from the U-Haul website shows a dramatic difference in price depending on which way you are going. There may be other reasons for the difference in price, but I surmise migration for employment opportunities is a major reason...It could NOT possibly be for the social programs Texas has...

Cost to rent a U-Haul Truck to move from Texas to California:

Cost to rent a U-Haul Truck to move from California to Texas:

|

| Source: Carpe Diem |

Cost to rent a U-Haul Truck to move from Texas to California:

Subscribe to:

Comments (Atom)