U.S. airlines raise fares as taxes lapse

Many U.S. airlines have raised fares in recent days to take advantage of a lapse in U.S. ticket tax collection after Congress failed last week to fully fund the Federal Aviation Administration budget, but passengers are not likely to notice any price difference.

The expiration of the FAA reauthorization on Friday means some aviation taxes are no longer being collected. These include a 7.5 percent sales tax on U.S. air transportation and a 7.5 percent sales tax on the purchase of air miles, said fare watcher FareCompare.com. Additionally, taxes on jet fuel are also reduced.

"Friday evening we adjusted prices so the bottom line price of a ticket remains the same as it was before prior to the expiration of federal excise taxes, etc.," American Airlines (AMR.N) spokesman Tim Smith said by email.

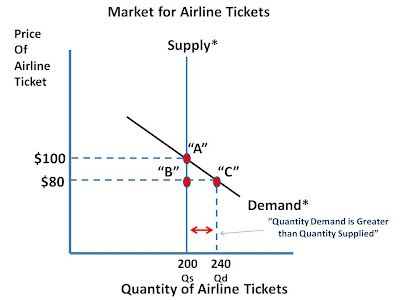

Let's look at this graphically. Assumptions: We look at one plane only with 200 seats. No matter what the price, there are only 200 seats REGARDLESS of what the price of the ticket is. Supply of tickets is Perfectly INELASTIC. The price of the ticket for the customer is $100 (see 1st graph) which includes the taxes levied BEFORE the latest event happened.

Assume the taxes submitted to the govt totals $20 of the $100 final ticket price. So, the price the airline actually receives for the flight is $80 ("Point B". This is illustrated in the graph below.

Without the $20 in taxes included in the ticket, the market price of the ticket SHOULD drop to $80 (Point "C"). Because the price of the ticket DECREASED ("ceterus paribus") we move ALONG the existing demand curve, downward and to the right to Point "C". According to our market demand curve ("Demand*") at $80 the QUANTITY DEMANDED is 240 seats. We can see that the QUANTITY SUPPLIED of seats is still 200. Our market is in dis-equilibrium where Quantity Demanded is GREATER than Quantity Supplied---we have a SHORTAGE of seats

It is clear that the market clearing price is $100 (Ceterus Paribus--assuming DEMAND does not increase or decrease). The quantity demanded will decrease as the price increases to clear the market and ration the 200 seats.

Yes, theoretically 40 people will be rationed off the plane as we move back to the previous market equilibrium price of $100 and 200 seats:

The key difference is that the airline is the beneficiary of this lapse in policy. In the short term, they reap an additional $20 per ticket. In economic terms, they are earning some "economic profits", profits over and above "normal profits"--Total Revenues - Total Costs (fixed costs + variable costs + opportunity costs).

We SHOULD expect competition to take care of these economic profits. The presence of economic profits sends a signal to the market that more seats are needed. An additional plane will be called into service and the SUPPLY of Airline Seats will INCREASE. The supply curve will shift to the right and the market price will decease to $80--the price of assumed "normal profits"...

Again, I made lots of simplifying assumptions, but overall this how the process works. I hope this helps you understand microeconomics a little better. :)

No comments:

Post a Comment