U.S.Plywood industry's plea for help rejected: Firms complain of Chinese 'dumping' on domestic market.

That's more than Sloan can say for the inside of the mill, where Columbia has been hit hard by Chinese competitors dumping plywood on the North American market, undercutting price by as much as 56%, says Gary Gillespie, Columbia's general manager for northern operations.

Dumping is defined by the U.S. Department of Commerce as a foreign company selling a product in the U.S. at "less than its fair value."

U.S. producers are crying foul and would like have tariffs imposed on each piece of plywood imported into the US.Welch testified before the ITC this past September, urging it to impose tariffs on Chinese plywood imports to ensure a "level playing field."Microeconomics has a lot to say about the effect tariffs have on the marketplace. I am going to show you graphically how this MAY/MIGHT play out in the Market for Plywood. This is an IMPORTANT concept in AP Microeconomics so I hope it will be helpful to you.

The following graphs have made up prices and quantities. They are just for instructional purposes and not to be taken literally.

If an economy is not open to trade with foreigners it is said to be in a state of Autarky (pronounced "Otter-Key"). The first graph shows the market in this state with a domestic price or $10.00 and a domestic market quantity of 1,000 pieces of plywood.

This next graph is the same as above but shows the areas of Consumer Surplus and Producer Surplus in equilibrium in autarky.

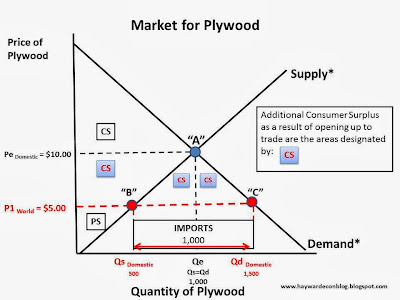

Now, assume the country engages in trade and comes out of autarky. The price of the same good when it is imported is $5.00. Half of the domestic price!

When the price of the good changes we MOVE ALONG the respective Supply and Demand Curves (Law of Supply and Law of Demand). We can see in the graph above, when the price is $5.00 the Domestic Quantity Supplied is 500 (Point "B") and the Domestic Quantity Demanded is 1,500 (Point "A"). Our Domestic Market for Plywood is no longer in equilibrium---Quantity Demanded ("C") is GREATER than Quantity Supplied ("B"). Normally this would result in a shortage, but the shortfall is going to be made up with IMPORTS or 1,000 pieces of plywood from China.

Important point: Notice what happens to Consumer Surplus in the graph below. There is additional CS for consumers: They get to "enjoy" more plywood at a lower price than before trade. However, notice that Producer Surplus is less than it was before. Some producer surplus was transferred to consumers. Producers are left with a small sliver on the bottom left hand portion of Supply*.

So, US consumers are much better off and US producers are much worse off.

Because US producers are worse off, they may choose to try to "level the playing field" by lobbying for a tariff to be assessed on imported plywood so the price will closer reflect the US cost of producing. In other words, to take away the un-competitive edge the foreign governments may have given their producer.

Assume they are successful and a tariff of $3.00 is levied on each piece of plywood (graph below). This will increase the price to $8.00.

Remember: PRICE increases we (again) MOVE ALONG our respective Supply Curve (from Point B" to "F") and Demand Curve (from Point "C" to "E"):

As a result of the tariff, we have a change in Imports, Domestic production, Domestic Consumption, Surplus, Dead Weight Loss, and Tariff Revenue. The most significant change is imports have been reduced to 500 pieces of plywood. The higher price as a result of the tariff induced the producers to increase quantity supplied by 250 (movement from "B" to "F") AND the the higher price has decreased the quantity demanded by US consumer by 250 pieces of plywood (movement from "C" to "E").

Other significant changes take place as well. These areas have the "?" in them and are important to be able to identify. Note they are all areas that USED to be Consumer Surplus. That is going to go away!

The first one (below) Producer Surplus is recaptured by US manufacturers of plywood. Because the price is now $8.00 in the marketplace they are induced to produce an additional 250 pieces of plywood (Law of Supply!).

The second area is "Dead Weight Loss" (DWL) to consumers. This is the area just below the Demand curve between Point "C" and "E". This means that as a result of the tariff consumers lose the benefit of purchasing 250 pieces of plywood at the lower import price of $5.00.

The second area of "Dead Weight Loss"(DWL) is attributed to "Society" (graph below). It is DWL because resources were allocated to produce additional plywood SOLELY as a result of the tariff. This implication is society could have benefited in two ways: (1) consumers could have enjoyed more plywood at lower prices from the foreign producer and (2) the resources allocated to produce the additional units of plywood could have been used for something else. You might recognize this as "Opportunity Costs".

Lastly, the some lost Consumer Surplus is transferred to the Government by way of the tariff. We can calculate the Tariff Revenue ("T.R.") by taking the amount of the tariff ($3.00) and multiply it by the number of imported pieces of plywood (500) and get $1,500. This area is not considered DWL because the tariff revenue could be used by the government to subsidize the production of another good, creating surplus somewhere else.

Oh, wait, isn't that what the foreign government did in the first place to create this situation? Makes you think, doesn't it?? :)