Secretary of State Hillary Clinton spoke briefly yesterday about the need for Afghan women and girls to be involved in the transition of security to the Afghan military. Clinton made these remarks at an international conference yesterday in London on the subject of Afghan security.

Clinton announced a Women's Action Plan that "includes initiatives focused on women's security, women's leadership in the public and private sector; women's access to judicial institutions, education, and health services; women's ability to take advantage of economic opportunities, especially in the agricultural sector." She described the program as "a comprehensive, forward-looking agenda that stands in stark contrast to al-Qaida's recently announced agenda for Afghanistan's women, attempting to send female suicide bombers to the West."

Thank you for visiting my blog. I post things I think will be of interest to high school students and teachers of economics/government/civics etc. Please leave a comment if what you find here has been useful to you. THANK YOU!

Saturday, January 30, 2010

THANK YOU, Secretary Clinton!!!!

THANK YOU, Secretary Clinton for reminding us of one of the reasons we are in Afghanistan (even if it is not the primary reason). The women (and young girls) of Afghanistan will suffer the most if we dont accomplish SOMETHING in the region...(Daily Kos)

"10 Resume Mistakes That Turn Off Employers"---GREAT ADVICE!!!!

Writing a resume is extremely difficult, but may be one of the most important documents you will ever produce. It is worth the time and energy to make sure you cover all your bases and have one that is effective. This article "10 resume mistakes that turn off employers" will help you avoid costly errors...

To Eat Cafertia Food, or Not to Eat Cafeteria Food...That is the Marginal Question...

WHY do you choose to eat cafeteria food?---Economics has the answer!! Marginal Analysis--how you make a decision when you factor out/in the cost and benefits of each particular choice you have when presented with a scenario. This cartoon shows how one may arrive at the decision to eat cafeteria food, usually not your first choice in dining. It presents it in terms of the desirablily of the choice (more gross to less gross, the Green Line) relative to the effort needed in obtaining that choice (the Blue Line). You will see the optimal point in the cartoon is where the "grossness" is equal to the effort. On the left side of this point the grossness exceeds the effort to obtain that choice, so it is not desireable. To the right of the point the effort to obtain the choice exceeds the cost of the choice. Is this an accurate portrayal of your decision making process in deciding where to eat? Be honest!!! This can apply to so many other daily decisions you make in the course of a day. Can you think of another scenario where you can use similar analysis???

'How SWWEEETTT it is, Alice"---well, that depends on where the Sugar comes from...

Sugar is an integral part of our food supply, mostly as an input into making a vast number of food items. We can buy sugar either from domestic producers or foreign producers. However, there are many trade restrictions in the form or quotas (limits on the amount that can be imported) or tarriffs (a direct tax on sugar by the pound). Either way, it increases the price of imported sugar. The graph shows over time the US domestic price of sugar and the world price of sugar. The world price is consistently well below the US price of sugar. Here is some basic facts/information (Carpe Diem):

Sugar is an integral part of our food supply, mostly as an input into making a vast number of food items. We can buy sugar either from domestic producers or foreign producers. However, there are many trade restrictions in the form or quotas (limits on the amount that can be imported) or tarriffs (a direct tax on sugar by the pound). Either way, it increases the price of imported sugar. The graph shows over time the US domestic price of sugar and the world price of sugar. The world price is consistently well below the US price of sugar. Here is some basic facts/information (Carpe Diem):Questions to ask:1. Americans consume about 9.412 million metric tons (20.75 billion pounds) of sugar per year, and therefore every 1 cent increase in sugar prices costs Americans an additional $207 million per year in higher prices.2. The U.S. produces about 6.9 million metric tons (15.4 billion pounds) of sugar annually, mostly from sugar beets.

3. Due to quotas, Americans are only allowed to import about 2.2 metric tons (4.85 billion pounds) of cane sugar every year, or about 23% of the total sugar consumed.

4. If sugar quotas were eliminated, and American consumers and business had been able to purchase 100% their sugar in 2009 at the world price in 2009 (average of 22.1 cents per pound) instead of the average U.S. price of 38.1 cents, they would have saved almost $2.5 billion.

1. Why do we not import more of the inexpensive sugar from foreign sources?

2. Who benefits the most from the quotas?

3. Why is Domestic sugar more expensive than Foreign sugar?

4. How does this effect (affect?) the price of goods that use sugar as a primary input/ingredient?

Friday, January 29, 2010

Rain, Snow or Sleet...How they are made....

If you are interested in weather, here is an interactive graphic that shows how different precipitations are created...Kinda fascinating...

Thursday, January 28, 2010

IPAD to dominate textbook market...So soon???

The games begin as people speculate on the influence the IPAD will/may have on various segments of our economy/culture. Just came across this comment and wonder what college students think about it...

Here is a link to a more serious look at the IPAD's potential effect (affect?) on the textbook market..

"My theory is that Apple wants to capture a chunk of the revenue in this nation's enormous textbook market -- high school, college, whatever. Why lug all those books around? The superior Apple graphics, colors, and fonts will support all of the textbook features which Kindle botches and destroys. Apple takes a chunk of the market revenue, of course, plus they sell the iPads and some AT&T contracts. There are lots of schoolkids in the world."I am a curious bystander who understands little of the technology and potential. I have wanted a Kindle for downloading books and newspapers, though. I will have to look at this closely. What do you techies think?

Here is a link to a more serious look at the IPAD's potential effect (affect?) on the textbook market..

$10 Million Federal Dollars in the toilet...No, really, it is IN the toilet...

You tell me...is this what "Fiscal Stimulus" is supposed to result in...

Read the story for the benefits and costs of this project...

Even as other states are shutting down highway rest areas to cut expenses, Texas is pressing ahead with a $262 million program to build or overhaul several dozen roadside stops.Yes, $10 million dollars for a (ONE) rest stop. I can see the jobs this project "created or saved"---I get that. But what SUSTAINABLE job(s) did "investment" in this project create or save that will contribute to further production in our economy? Spending for projects like this should be a by-product of tax revenue collected from an improving economy, not from borrowed money. Some entreprenuer somewhere could have used that money for a start-up that actually creates a NEW job (or two or 100...) that did not exist before...

"The Texas rest areas are the absolute best in the entire country," Jan McCarter said during a stop last week at an Interstate 35 rest area in Salado, north of Austin. As she spoke, she walked her lap dog, Rocky, on a vast lawn at the rest area, which was built for $10 million and opened a little more than a year ago.

Read the story for the benefits and costs of this project...

Words Matter---State of the Union analysis...

FASCINATING GRAPHIC...Shows various Presidents First State of the Union addresses in terms of the frequency of use of various words. The bigger the word relative to other words in the speech the more a President used that particular word...Words matter!!!

Wednesday, January 27, 2010

Private Property Rights...Topic of Todays AP Microeconomics Class...

As discussed today in AP Microeconomics, this short editorial (worth a read) re-inforces my point that private property rights are the fuel that makes our economic engine run...

This month's horrendous earthquake in Haiti brings to mind the economic question of greatest importance to Adam Smith: What causes wealth? What conditions best encourage economic growth and widespread prosperity? Why are the Haitians and North Koreans so poor while Americans and South Koreans are so rich?

The general answer is easy: private property rights and freedom of contract. When everyone enjoys the right to acquire, own, use and exchange property rights voluntarily, free markets result. And free markets, in turn, promote an ever-finer specialization of labor and increasingly complex commercial and industrial arrangements. The consequence is widespread and growing prosperity.

Tuesday, January 26, 2010

Let the Budget Cutting Begin!! And quickly end....

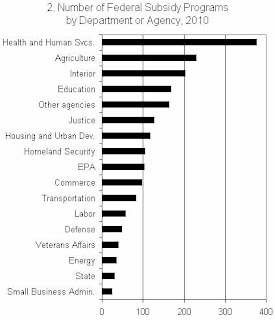

The President is proposing cutting Discretionary Federal spending by $250 billion over 10 years, or more simply, $25 billion per year for 10 years. Entitlements like Social Security and Medicare will not be affected, as well as defense spending, homeland security, veterans, and international affairs. I would like to help him out with a suggestion. An area ripe for cutting is subsidies. However, cutting these are going to be the MOST difficult because they are closely tied to powerful interest groups who are usually strongly defended by the Senator/Congressperson who requested the subsidy. Watch for ALL the interest groups and their lobbyists to pounce on this one...Below is a graph of the number of subsidies granted over time. The graph below this one shows in what Federal agency is responsible for the subsidy....

Cutting subsidies from Health and Human Services is going to be especially problematic...

iWANT one!!

What will Apple call its brand-new gizmo?

APPLE will unveil a new gadget to the press on Wednesday January 27th. Although the company has remained tight-lipped about what its “latest creation” might be, the smart money is on its much-anticipated tablet computer. Mystery surrounds exactly what this new device will do, though it seems certain that it will combine an e-reader, to take on Kindle and the like, internet connectivity and a touchscreen like the iPhone. But what will Apple call the device that could change the way that newspapers, books, television and computer games are enjoyed? Paddy Power, an Irish bookmaker, is offering odds on the likely contenders with iSlate and iPad the favourites.

Monday, January 25, 2010

Cotton and Corn---A relationship based on price...Can it last??

"Demand Gives Cotton a Lining"---WSJ

This article offers an excellent lesson in supply and demand in a real world scenario...The focus is the cotton market but it mentions corn as well.

This graph shows the market for corn and cotton at a starting equilibrium point...

What is the connection between cotton and corn? Both are grown on land that is suitable for growing either, for the most part. Farmers are relatively indifferent as to which one to grow, but they are motivated by price.

The demand curve shifts to the right ("D1") indicating and increase in demand. The price of corn INCREASES ("B"). Cotton farmers, attracted by the increase market price for corn PLUS the Federal subsidies, quickly started to produce corn instead of cotton. This led to the DECREASE in SUPPLY of cotton on the market. This is indicated in "Graph #2" with a leftward shift of the supply curve ("S1"). The market price of cotton ("B") is now higher too!

This article offers an excellent lesson in supply and demand in a real world scenario...The focus is the cotton market but it mentions corn as well.

This graph shows the market for corn and cotton at a starting equilibrium point...

What is the connection between cotton and corn? Both are grown on land that is suitable for growing either, for the most part. Farmers are relatively indifferent as to which one to grow, but they are motivated by price.

Since 2006, cotton acreage has declined year-over-year as farmers reacted to higher corn and soybean prices that were driven up in part by biofuel demand. In 2009, U.S. cotton plantings totaled only 9.15 million acres, a 26-year low....The DEMAND for Corn INCREASED because of the Ethanol mandate of 2006 requiring ethanol to be added to the fuel supply. This dramatically INCREASED the DEMAND for corn by ethanol producers. This is shown in "Graph #1.

The demand curve shifts to the right ("D1") indicating and increase in demand. The price of corn INCREASES ("B"). Cotton farmers, attracted by the increase market price for corn PLUS the Federal subsidies, quickly started to produce corn instead of cotton. This led to the DECREASE in SUPPLY of cotton on the market. This is indicated in "Graph #2" with a leftward shift of the supply curve ("S1"). The market price of cotton ("B") is now higher too!

The world will need all the extra cotton acreage it can get this year, given that demand is expected to rebound. Ron Lawson, managing director at Logic Investment Services in Napa Valley, Calif., pointed to U.S. Department of Agriculture data that peg world cotton consumption at 114.36 million bales in the current 2009-10 marketing year that ends July 31. That figure is 10% higher than production estimates in the same time frame.The anticipated INCREASE in demand will, potentially, further increase the upward pressure on the price of cotton. The increase in demand is shown in this graph...

The demand curve shifts to the right ("D1") indicating an increase in demand in the market for cotton. The price increases to "C", higher still!

Questions:

1. What signal is the elevated price of cotton going to send farmers of corn, wheat, soybeans?

2. What may happen to the price of clothing?

3. What may happen to the price of corn as a result of the increase in the price of cotton?

4. In response to question #3, what may happen to the price of gasoline?

No one said this was going to be easy...:)

List of LARGEST Political Donors to candidates/ parties...Who stands to benefit from recent Supreme Court Decision??

Sunday, January 24, 2010

Thomas Friedman Shifts the PPF in his latest column---I provide the Graphs!!

The problem confronting the economy is how to create jobs and increase future opportunities for students in school today. First, we need to work to put people to work within the under-utilized production capacity the US economy currently has. Right now we have lots of unemployed and under-employed resources (people, equipment, office buildings, factories, and other infrastructure) that are not at their optimal productive capacities. Friedman is looking past this and into the future---how are we going to INCREASE our productive capacity to absorb all the new entrants (YOU!!) into the economy when you are prepared, after your education, to enter it.

"What the country needs most now is not more government stimulus, but more stimulation. We need to get millions of American kids, not just the geniuses, excited about innovation and entrepreneurship again. We need to make 2010 what Obama should have made 2009: the year of innovation, the year of making our pie bigger, the year of “Start-Up America.”..."Obama should bring together the country’s leading innovators and ask them: “What legislation, what tax incentives, do we need right now to replicate you all a million times over” — and make that his No. 1 priority. Inspiring, reviving and empowering Start-up America is his moon shot..."To illustrate, we use the Production Possiblities Frontier. This model represents the productive capacity of an economy IF it is fully-employing all of its productive resouces--land, labor, capital, entrepreneurship in the LEAST costly way. In other words, how much can we produce as efficiently as possible given our societal resources. Refer to the graph below:

An economy can produce two broad categories of goods---(1) Capital Goods, which are goods designed to add to productivity, such as education, skilled labor, machinery, computers, factories, etc. Essentially the things we invest in today so that it enhances our ability produce in the future. The amount of Capital an economy has is part of its "CAPITAL STOCK"--or Stock of Capital to produce goods. The quality and quantity of Capital Stock is VITAL to an economy's current and future standard of living. (2) Consumer Goods are goods produced for present consumption and don't significantly add to future production ( food items basic to survival, fast food, consumer electronics, clothes, appliances and other "consume now" goods.

Assume our economy is producing at Point "A" on our graph. Because we are ON the PPF it means we are utilizing all of our productive resouces in the least costly way. We are said to be "PRODUCTIVELY EFFICIENT" at this point, fully employing all our productive resources at the lowest cost in terms of societial resouces. Now, do we HAVE to produce at Point "A"? NO! We COULD produce ANYWHERE on the PPF, but this economy finds itself producing "X* Capital Goods and "Y* Consumer Goods" . This seems to be this economy's preferred bundle of Capital and Consumer Goods. WHERE a society decides to produce on the PPF is called an "ALLOCATIVE EFFICIENCY" decision. So, this economy is productively efficient at point "A" and it has reached and allocative efficiency at point "A" as well...

I believe Friedman is suggesting (in this article and MANY others) that what we should do is shift resources towards "activities" that promote furture economic opportunities, ergo economic growth. This would entail "giving up" some current consumption and investing in education, entrepreneurship, and "capital" so we can create the jobs of the future. This would nessecitate a movement along our PPF to a new point, Point "B". (See Graph below) Remember, we MUST give up something in order to have more of something else (OPPORTUNITY COST!)

At Point "B" we are producing MORE Capital Goods relative to Consumer Goods compared to our previous Point "A". We have ADDED to our CAPITAL STOCK and subtracted from our Consumer Good production.

With this INCREASE in Capital Stock the economy now has the ability to produce MORE Goods (we have better education, more innovation, more entrepreneuship) that will lead to MORE productivity gains. Our PPF will INCREASE, or shift to the right reresenting the economy's ability to produce MORE CAPITAL AND CONSUMER GOODS. See Graph below...

At Point "C" the economy can now produce Y2 number of consumer goods AND... (see graph below).

...we can now produce "X2" number of Capital Goods...Essentially, we can now produce MORE of BOTH Capital and Consumer Goods...Think about it this way---we gave up present consumption in order to invest in the future. With the subsequent increase in Capital Stock we can now produce more goods. The economy is going need MORE workers to produce those goods. Workers will have more income (and the nation as a whole will also) and they will want to buy MORE consumer goods and that will stimulate production of consumer goods (which the economy can NOW accommodate )...As a result, the WHOLE PPF will shift to the RIGHT representing an INCREASE in Productive Capacity. The economy can produce any bundle of Captial and Consumer Goods that is GREATER than it could at the previous PPF. More "stuff" means a higher standard of living!! ..This is what ECONOMIC GROWTH REALLY is!! (for better or worse)...

Can you see the PPF shift before your eyes???Obama should bring together the country’s leading innovators and ask them: “What legislation, what tax incentives, do we need right now to replicate you all a million times over” — and make that his No. 1 priority. Inspiring, reviving and empowering Start-up America is his moon shot....You want more good jobs, spawn more Steve Jobs. Obama should have focused on that from Day 1. He must focus on that for Year 2.

Questions to ask

1. Is Friedman right about what we should do to promote economic growth?

2. Are there other things we can do to promote economic growth?

3. Are the policies that Congress is pursuing now (Healthcare, Banking reform, Cap and Trade, etc) going to hurt or enhance future economic growth? Find the postitve and negatives!!!

Subscribe to:

Comments (Atom)