Recently the city of Philadelphia imposed a 1.5 cent per ounce tax on the sale of "Sugary Soft Drinks" or "SSD's" for short.

This means, for instance, a 16 ounce can/bottle of Coke will have an additional tax imposed totally $.24 (24 cents = 1.5 cents X 16oz).

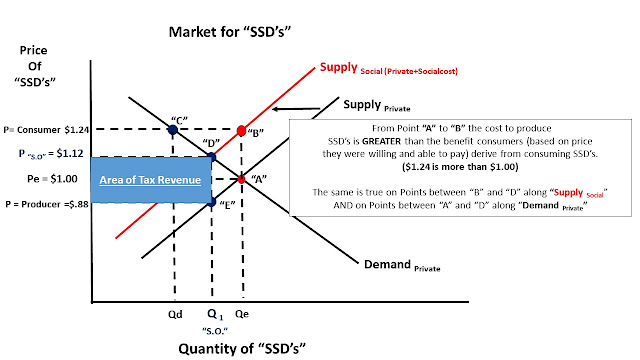

The City believes this class of beverage causes health problems and costs that are not captured in the price of sugary soft drinks.

This is covered in AP Microeconomics in the unit on "Market Failure" where we learn how an external cost that is imposed on "third parties" specifically, or society in general, is not borne by the producer and/or consumer of the product.

Even though I might not consume soft drinks (or to the extent you do), I may have to pay for the health problems that stem from your consumption.

I put together a series of slides that explain with words and graphs how a government might address this issue through taxation to correct this "negative externality" and bring the market to a point where it produces SSD's at a more "socially optimal" price and quantity.

Hope it helps. Thanks.