It is rather easy, actually, given the aggregated tax policies enacted over time.

There are some basic deductions that you are allowed to subtract from your total income. These deductions effectively reduce the amount of income that is actually subject to the income tax. Deductions reduce your income subject to tax dollar for dollar.

Also...

There are some basic tax credits that you are allowed to subtract from your total tax bill. Tax credits reduce your taxes owed dollar for dollar. Notice the difference between a deduction and a tax credit. This is important when discussing tax policy.

Both of these are dependent on whether you qualify for them. Some everybody is entitled to and some you get only if you meet certain criteria.

Deductions and tax credits are enacted to further some social, economic, or political goal. Individually, they are supposed to serve as an incentive to bring about a desired outcome that benefits society. Collectively, they could serve that purpose OR collectively create problems and/or inefficiencies.

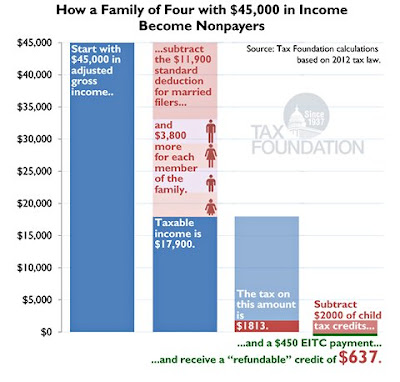

The following graphic illustrates how a person (or household in this case--a family of 4) earning $45,000 per year in income can owe no Federal Income Tax on that income by using the available income deductions and tax credits.

This assumes the families total income from all sources (wages, interest earned on savings accounts, and "other") is $45,000.

This couples filing status is "Married, filing jointly" (I assume) and includes both of their incomes combined OR it could be just one of them is the sole income earner. It does not matter.

Right off the top, they are entitled to take a deduction of $11,900 for just being married. I will keep it at that and do another posting on how your tax bill will be affected by other potential filing statuses. This deduction ("subsidy") serves to help reduce taxable income in an effort to help defray the cost of running a household with the goal of keeping families together and encourageing couples to stay married. That is/was the intent of the tax policy.

Next, the taxpayer can deduct from taxable income, $3,800 for each person in the household who is legally dependent on the taxpayer. Generally this means children, but it could be a parent, grandparent, or other dependent. You also INCLUDE yourself AND your spouse in the calculation. This equals ($3,800 X 4) $15,200. See how you and your spouse were "double counted" in the calculation, first for being married then as a member of the household. Assuming no other deductions you are allowed to take, the your income that is ACTUALLY subject to taxation is now ($45,000 - $11,900 - 15,200) $

17,900. This amount is called your "Taxable Income". It is derived after taking all of your legally available income deductions.

The Federal Income tax owed on $17,900 is

$1,813. If we stopped right there this is how much the taxpayer would write a check to the IRS for ASSUMING they did NOT have any "Federal Withholding" from their paychecks throughout the year. We will assume that for this exercise, but is likely they would have had some withheld. Any withholding would off-set the amount of tax owed, either partially or totally.

This taxpayer now finds they are entitled to a Child Tax Credit of $2,000 ($1,000 for each child). Taxpayers with an adjusted gross incomes of $110,000 or less are eligible for this credit, so this is not necessarily a "gift" to lower income people, however it benefits them a great deal. Remember, tax credits reduce your taxes owed dollar for dollar.

Now, we subtract that $2,000 from our taxes owed of $1,813 and we now owe -$187.00 in taxes. Sweet!! The Child Tax Credit is considered a "refundable tax credit" which means if the credit results in a negative number, the taxpayer owes $0.00 in taxes but they are entitled to the $187.00 too!

We are not done with our tax credits yet. The next one is called the "EITC", which stands for Earned Income Tax Credit. This credit is targeted towards low income people--single, married, with or without children. It is considered a significant anti-poverty policy and enjoys significant bi-partisan support in Congress and the Presidency. The EITC is WAY TOO COMPLICATED to explain in a few sentences.

Wikipedia has a pretty good summary of it here.

This family qualifies for this tax credit too, to the tune of $

450. Because this credit is 'refundable" as well, we subtract it from our tax bill, which currently is a negative $187.00. So if you add this credit to the the total, this family will receive a tax REFUND check of

$637.000.

This family effectively pays no federal income tax on their $45,000 AND they get an extra $637 to consume or save.

This is certainly a form of income re-distribution BUT as I mentioned earlier, both of these tax credits in particular enjoy bi-partisan support, historically.

So, now you know how someone earning $45,000 per year can have no tax liability and receive a refund check as well.

This is a working person (could be a teacher with THAT salary) who would be considered a member of the 47%. Working and has a good job, but the net recipient of tax dollars.

Hope this helps with your understanding of the issue.