This is the result of an archaic provision that says if the bill is NOT renewed in a timely manner then the formula for determining the prevailing "Price Floor" paid to dairy farmers will revert to calculating the price floor using 1949 (yes, you read that right) production costs. Adjusted for inflation, that means the price floor is estimated to DOUBLE, hence doubling the price of milk overnight.

A price floor is used to help reduce individual farmers exposure to market price fluctuations that agricultural commodities are routinely subject to due to factors generally out of control of the farmer. It guarantees, in advance, the farmer will receive a minimum price for their commodity if the bottom falls out of the market and the market price falls below production costs. This has been farm policy in the US since the 1930's.

If the market price decreases (demand decreases, supply increases, or some combination of both) then the farmer receives the predetermined Price Floor price. The Price Floor in this case is said to be "Binding" on the market. The Price Floor price will become the de facto market price for everyone else.

If the market price increases (demand increases, supply decreases, or some combination of both) then the farmer receives the market price and not the Price Floor price. The Price Floor is said to be "Non-Binding"on the market. Farmers are receiving a market price HIGHER than the Price Floor. They are better off and don't need the Price Floor to fall back on.

The purpose of the Price Floor is to keep farmers from losing money in the short-run so they can stay in business. It guarantees them a certain amount of income to meet expenses and hopefully break-even, at best, at the end of the harvest.

Here is the kicker: Right now the market price for milk is HIGHER than the Price Floor (dairy farmers are not unhappy at this point). The Price Floor is "Non-Binding". However, if the Farm Bill does not pass in a timely manner, the Price Floor is expected to increase significantly ABOVE the market price and the Federal Govt will pay the Price Floor price to farmers. The Price Floor will become the new de facto market price everyone else pays.FOR NO OTHER REASON THAN THE INACTION OF THE HOUSE AND SENATE!

Below the fold, is my detailed explanation of how a Price Floor works. Complete with graphs!!!

This is an important concept in Microeconomics, so I hope it helps with understanding how this particular government action described above affects a market.

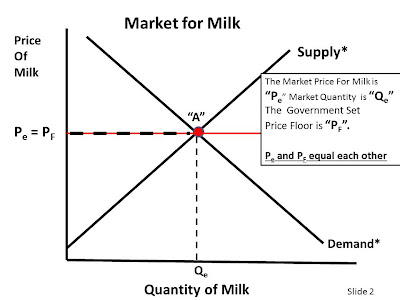

Slide 1 shows our Market for Milk in equilibrium at price "Pe" and market quantity "Qe".

Slide 2 shows the insertion of the PRICE FLOOR set by the Govt. This is the horizontal RED line at "Pf=Pe". Assume currently it is the SAME price as the Market Price. So, the market price = the price floor. A this time, the price floor has NO effect on the market at all.

Slide 3---Assume the DEMAND for milk DECREASES. The Demand curve shifts to the left. We settle at a new equilibrium Price "P1" and Market Quantity "Q1"---Point "B". Now, our Market Price is BELOW the Price Floor set by the govt.

Slide 4 NOTE: Just to clean the graph up and make it easier to read, I deleted the FIRST Demand Curve. This is what we are left with.

Slide 5 (Key Slide!). Dairy Farmers are now receiving a price that is less than the price they were receiving before the decrease in demand. As promised by the Federal Govt, when the market price falls below the price floor, the govt steps in an buys milk from dairy farmers at the Price Floor price ("Pf").

The Price Floor is HIGHER than the new market price. When this occurs, the Price Floor is said to be "Binding". In other words, the Price Floor will be the de facto market price AS LONG as the market price for milk is below the established Price Floor.

At the Price Floor "Pf", the Quantity Demanded is "Q demanded"---Point "C". However, at "Pf" the quantity supplied is "Qsupplied"---Point "A" (note: Point "A" was our original equilibrium price and quantity).

Quantity Supplied (in the Private Market) is GREATER than Quantity Demanded (in the Private Market). We have a SURPLUS of Milk in Market (the difference between Point "A" and Point "C").

Important point: The producers are still selling the same amount of milk as before (Point "A") but more of it is going to the Federal govt than to the Private Market (Point "C", Q demanded).

Dairy Farmers are going to sell their milk to the highest bidder! In this case it will be the Federal Government. More sold to the govt, less available to the private market (you and me). This is not a usual thing to do, but in Slide 6 I segment the supply curve to show this---Supply Curve (Private Market) intersects the demand curve at Point "C".

Make sense??? I hope so. Now, let's look at the REAL WORLD situation that might emerge in the Market for Milk if Congress does not take action on renewing the Farm Bill.

Slide 8 show the Market for Milk in equilibrium at "Pe" and the established Price Floor at "Pf".

Slide 9 and 10. Assume Demand for Milk increases. The Demand curves shifts to the Right. The market price ("P1" at Point "B") is ABOVE the Price Floor, so the Price Floor is "Non-Binding". All is well with the dairy farmer!!

Slide 11. OPPS!! Congress neglects to renew the Farm Bill so the Price Floor shifts UP to "Pf", ABOVE the market price. Again, we have a SURPLUS which the Federal govt buys at the higher Price Floor price. Less is available for the Private Market. The Price Floor becomes the de facto market price everyone else pays. Sound familiar???

No comments:

Post a Comment