Data from CDC HERE

An estimated 44 million Americans smoke. Of that 44 million an estimated 30%, or 13.2 million live at or below the poverty line.

The price of cigarettes varies significantly around the US. A low of $4.84 in West Virginia to a high of $12.50 in New York. Prices include a significant tax. The median price is about $7.00.

If a person smokes 3 packs a week at the median price of that is $21.00 per week spent on cigarettes. At a minimum wage of $7.25 per hour (MINUS payroll taxes of 7.65% that would be $6.73 per hour) it takes just a little MORE than 3 hours to earn the money to buy cigarettes PER WEEK. 3 HOURS!

There are 4.3 weeks in an average month. A 3 pack a week smoker working at minimum wage will work 13 hours a month in order to spend $90 on a cigarette habit.

Opportunity Cost. What ELSE could a minimum wage worker spend their money on instead of cigarettes? Yes, I know, it could be on worse things. But it could be on better things as well.

Notice I am not taking the nanny state approach and telling you what you should or should not do.

I am doing what economists do: Putting a cost to an action then letting people decide.

However, on personal note, students: DON"T SMOKE!! It is harmful to you and to society (what good could you do with that $90 extra PER MONTH!!). I watched my father die a terrible death as a result of a lifetime of smoking.

Thanks!

Thank you for visiting my blog. I post things I think will be of interest to high school students and teachers of economics/government/civics etc. Please leave a comment if what you find here has been useful to you. THANK YOU!

Friday, June 21, 2013

The Dollar is Appreciating in value in the FOREX. That HAS to be good, right? Well, yes and no. Let me explain...

In an era of globalization, the value of one currency relative to another is no small thing. Any changes in relative values can have significant effects on an economy. This short article discusses the ramifications of an Appreciation of the US dollar in the Foreign Exchange Market on US exports---stuff we make and sell to foreigners.

Are U.S. exports about to get hammered by the rising dollar?

After Fed chairman Ben Bernanke’s press conference on Wednesday, the dollar started climbing against major developed nation currencies as well – rising nearly a percent against the euro and the British pound, and around 1.5 percent against the Japanese yen. The dollar index, measuring its value against six other major currencies, rose 1 percent Wednesday and was up another 0.5 percent Thursday.

If that global trend continues, it makes U.S. products – from soybeans to trucks and airplanes – more expensive overseas at a time when the Obama administration is banking on international sales of American goods to generate jobs.

Simple example. I sell widgets to Europeans at a price of $100.00. Assume the exchange rate is 1 Euro = 1 Dollar (reciprocal is true 1 Dollar = 1 Euro). So a European exchanges 100 Euros for 100 Dollars and buys my widget.

Assume the exchange rate changes such that 1 Euro = 80 US Cents (the reciprocal would be 1 Dollar = 1.25 Euros ). This means for Europeans to get enough US Dollars to buy my Widget they would need to exchange 125 Euros ($100 Dollars/the exchange rate of 80 US Cents = 125). That makes my widgets 25% more expensive for Europeans. I am likely to sell much less to them!!

Hold on. The article suggests this might not be quite that bad.

Exchange rates don’t have a one-to-one effect on the prices of final goods. Global companies use different strategies to protect against currency swings, and many firms rely on imported parts and other inputs – which get cheaper when the dollar is stronger, offsetting the impact of a rise in the value of the currency.If I happen to use a significant amount of European sourced INPUTS in my making my final OUTPUT of widgets, the outcome will be a little different.

Assume half of the cost of producing my widgets (50 Dollars) comes from materials I buy from Germany (imports to the US). Before the currency change I exchanged 50 Dollars for 50 Euros. AFTER the currency rate change I only have to exchange 40 Dollars to get 50 Euros (50 Euros/the exchange rate of 1.25 Euros = 40). So now my costs have decreased 10 Dollars.

If I am in a competitive market, then my price for widgets will decrease from 100 Dollars to 90 Dollars. At that price, Europeans will need to exchange 112.50 Euros to buy my widget (90 Dollars/80 Cents= 112.50).

Better than the 125 Euros we calculated before but more importantly it accurately reflects what happens with trade when currencies change in value relative to each other.

If a US business relies heavily on domestic sourced inputs then the effect of an appreciating currency is greater and can have a larger impact on exports. The Quantity Demanded for US goods/services will decrease.

The more a US business relies on imports for a significant amount of its inputs, then an appreciation of the dollar can have a less adverse effect on exports. The Quantity Demand for US goods/services will decrease, but by a lesser amount.

The Law of Demand is hard to defeat.

As with most things, the deeper you dig the less clear and complex they become.

Thursday, June 20, 2013

"Drill, Dig, Baby, Drill, Dig"...Not what many people want to hear BUT it has helped save our economy. Doubt it? Look at these numbers...

I copied this chart from the teriffic website EMSI and added some numbers based off of their data.

The EMSI data show how many jobs there are in certain sectors of the energy and mineral extraction industry and how many ADDITIONAL jobs down the supply chain are needed to support those jobs. From this, they calculate a "jobs multiplier" (This discussion is excellent--go read it!!!).

Example: In "Support Activities for Metal Mining" there were a total of 5,103 jobs in that specific category in 2013. EMSI estimates that for each of those jobs 7.09 additional jobs were created as supply chain support jobs. So, that category produced a total of 36,180 jobs---the 5,103 direct ones and 31,077 indirect ones created to support those 5,103. Hope that makes sense.

I was curious as to how many DIRECT jobs were created since 2010 (the end of the recession) and the number of supply chain support jobs created as a result. They did not have those numbers broken out, so I had to calculate them.

Those numbers are in columns "1" and "2" in bold.

Column 1 has the number of NEW jobs created in each category since 2010.

Column 2 has the number of NEW supply chain support jobs created in each category since 2010, using the same multipliers.

Add them all up. Since 2010 the number of new direct jobs created is 189,451 and the number of supply chain support jobs is 404,157.

Total jobs created in these categories in the last 3 years and 5 months was 593,608.

Using employment numbers from the BLS archives (Jan 2010 to May 2013) the economy has added 3,969,000 new jobs since January 2010.

So, jobs in the Energy and Mineral Extraction sector have accounted for a MINIMUM of 15% (593,608/3,969,000 X 100) of ALL new jobs since 2010.

Read that percentage again. That is significant.

"Drill, Dig, Baby, Drill, Dig". I am pretty sure this has helped save our economy...

The EMSI data show how many jobs there are in certain sectors of the energy and mineral extraction industry and how many ADDITIONAL jobs down the supply chain are needed to support those jobs. From this, they calculate a "jobs multiplier" (This discussion is excellent--go read it!!!).

Example: In "Support Activities for Metal Mining" there were a total of 5,103 jobs in that specific category in 2013. EMSI estimates that for each of those jobs 7.09 additional jobs were created as supply chain support jobs. So, that category produced a total of 36,180 jobs---the 5,103 direct ones and 31,077 indirect ones created to support those 5,103. Hope that makes sense.

Those numbers are in columns "1" and "2" in bold.

Column 1 has the number of NEW jobs created in each category since 2010.

Column 2 has the number of NEW supply chain support jobs created in each category since 2010, using the same multipliers.

Add them all up. Since 2010 the number of new direct jobs created is 189,451 and the number of supply chain support jobs is 404,157.

Total jobs created in these categories in the last 3 years and 5 months was 593,608.

Using employment numbers from the BLS archives (Jan 2010 to May 2013) the economy has added 3,969,000 new jobs since January 2010.

So, jobs in the Energy and Mineral Extraction sector have accounted for a MINIMUM of 15% (593,608/3,969,000 X 100) of ALL new jobs since 2010.

Read that percentage again. That is significant.

"Drill, Dig, Baby, Drill, Dig". I am pretty sure this has helped save our economy...

Wednesday, June 19, 2013

If you are interested in either the environment or national security in terms of energy consumption, my discussion (and graphic) here of the situation will interest you. The news ain't good...

Here is a graphic that appeared on the blog Conversable Economist regarding world fuel consumption. It is the clean version. Below I took the same image and did some calculations. Take a gander at what I did...

I was curious about how things have changed since EVERY political cycle we hear an earful about how we need to move to cleaner sources of energy. Whether it is for environmental and/or national security reasons.

I used 1994 (almost 20 years ago) as my base year ONLY because I did not have the hard data to do the calculations and relied on the eyeball method. So, my numbers may not be exact but I believe in the ballpark. Grant me some math grace, please.

In 1994 fossil based fuels accounted for 88% of world energy consumption. Nuclear, renewables and hydo-electric account for the other 12%. You can see the share each source of fossil fuel (coal is gray, natural gas is red and oil is green) was as a percent of the total in 1994. I did the same thing for 2012. Those numbers are smaller and in parenthesis. In 2012 the world economy was 86% dependent on fossil fuels. A 2-percentage point decline in 20 years.

Coal is a very dirty source of energy but it is cheap, cheap, cheap relative to the others (natural gas is second).

Whatever your concern is, environmental or security, we are not out of the woods yet in terms of providing for our energy needs.

Tuesday, June 18, 2013

Wanna help low income people? End a shoe tariff that protects NO US shoe industry jobs so shoes can become cheaper overnight. Why can't Congress and the President do this simple thing??

If Congress and the President were really serious about doing something easy, practical and HELPFUL for low income people they would eliminate the tariff (tax) on imported shoes. This tax is highly regressive and would do wonders in boosting the purchasing power of those households.

It is a tax that was put in place in the 1930's to protect the US shoe manufacturing industry from low cost foreign producers. There are NO mass low cost producers of shoes in the US anymore. This tax is protecting no US jobs in that sector It is simply a revenue producer for the Federal Govt.

From an article at the BBC:

It is a tax that was put in place in the 1930's to protect the US shoe manufacturing industry from low cost foreign producers. There are NO mass low cost producers of shoes in the US anymore. This tax is protecting no US jobs in that sector It is simply a revenue producer for the Federal Govt.

From an article at the BBC:

"From the importer to the distributor to the retailer, that price is marked up to create profit margins," says Matt Priest, president of the Footwear Distributors and Retailers of America (FDRA).

"So looking at a children's shoe at $9.99, $3-4 of that could be attributed to the tariff paid at the border."

By eliminating that barrier, put in place by the Tariff Act of 1930, prices will fall in the mass market, he says.

"If Walmart was to pass on that saving to consumers, the competitors will follow. If you're a single mum with three kids and you have to buy them shoes once a quarter you're talking about a decent saving just by eliminating this tax."

Offering a "Free" Class and the Tragedy of the Commons. The teacher becomes the student...

I recently offered a FREE week long class for home schooled that covered the basics of supply and demand. I did this because I wanted a way to advertise my Fall semester AP Macroeconomics class I offer online. I also did it because I LOVE teaching the subject. The class met for 1 hour and 15 minutes Monday through Friday.

Twenty-two students faithfully attended every day. Sixty-eight students originally signed up. Because of the initial interest signaled by those 68 I created two additional class period offerings each day so the one class would not be huge and to give those interested a choice of when to attend.

Four parents wrote me to say they could not attend as they planned. The rest, well, simply did not care enough to respond---just did not show up.

Tragedy of the Commons---give away something for free and it is valued as such by most at the expense of the few.

For those who attended I would like to thank you all VERY much. I hope the week was productive for you. It was my pleasure to serve a terrific group of home-schoolers and your parents.

Twenty-two students faithfully attended every day. Sixty-eight students originally signed up. Because of the initial interest signaled by those 68 I created two additional class period offerings each day so the one class would not be huge and to give those interested a choice of when to attend.

Four parents wrote me to say they could not attend as they planned. The rest, well, simply did not care enough to respond---just did not show up.

Tragedy of the Commons---give away something for free and it is valued as such by most at the expense of the few.

For those who attended I would like to thank you all VERY much. I hope the week was productive for you. It was my pleasure to serve a terrific group of home-schoolers and your parents.

How does your income rank relative to everyone else in the US. You might be richer than you think.

Adjusted Gross Income (AGI) is the amount of your income (or combined household income) that is subject to Federal Income taxes AFTER you take all the tax deductions and/or credits your are entitled to.

Where do you (or your household) fall?

Look at the yellow highlighted row of numbers (for the latest year data is available--2010)

If you are a "1 Percenter" then your AGI is $369,691 or higher. You are in the top 6% of income earners if your AGI is $161,579 or higher (includes the 1%-ers too).

You are in the Top 10% of income earners if you AGI is $116,623 or higher (includes everyone above that too).

Are you surprised the threshold is so low? You may be richer than you think!! :)

Where do you (or your household) fall?

Look at the yellow highlighted row of numbers (for the latest year data is available--2010)

If you are a "1 Percenter" then your AGI is $369,691 or higher. You are in the top 6% of income earners if your AGI is $161,579 or higher (includes the 1%-ers too).

You are in the Top 10% of income earners if you AGI is $116,623 or higher (includes everyone above that too).

Are you surprised the threshold is so low? You may be richer than you think!! :)

Monday, June 17, 2013

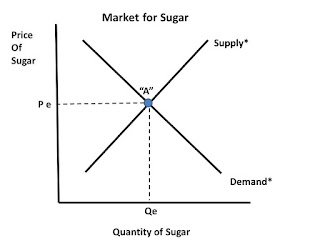

Interest group politics and how it affects the market price for sugar. Concentrated benefits and dispersed costs. THAT is how you lobby.

Here is an excellent example of government intervention in the market place to achieve a specific policy goal. The goal is to protect sugar growers from projected lower prices due to a bumper crop of sugar this growing season.

The U.S. Department of Agriculture plans to buy sugar from domestic growers, the government's first direct intervention in the nation's sugar market in 13 years.

The move is aimed at helping to whittle down a surplus that has driven prices to four-year lows and is threatening to spark a wave of defaults on almost $700 million of government loans.Producers took out loans guaranteed by the Federal Govt to finance the planting season. Repayment of the loans was predicated on the anticipated market price at the time the sugar would be sold. Because of the increase in supply, the price is expected to decrease well below the repayment terms. This means the growers will not have adequate revenues to pay back the loans.

Here is my graphical representation of what is going on.

The first graph shows the market in equilibrium.

If left alone, the market supply curve would shift to the RIGHT ("Supply 1") and the market price would drop to "P1" at Point "C" as it is anticipated to do.

Not so fast. As the excerpt above suggests the Fed Govt is going to purchase that SURPLUS before it has a chance to impact the market place.

"Supply 1" will shift back to the original position "Supply*".

And we will be back to where the market was before, assuming no other variables changes.

Benefits accrue to a relatively small faction of the economy, sugar growers. The costs are dispersed among all consumers and businesses that use sugar as an input to make many other products.

Subsidies distort market prices and provide an incentive to over-produce.

"Intentions should not be confused with results"---this logic does not apply to Farm Bill policy---Subsidies for water saving equipment results in MORE water usage. Sigh...Predictable...

A nice example of an un-intended (but predictable) consequence of a policy designed to address a specific problem but ends up making things worse. As I have read elsewhere, "you don't want to confuse intentions with results". However, seems like much public policy is determined this way.

Subsidies are public transfer payments from the government to producers. Subsidies reduce the cost of production of a final good or service so we end up with more of that good or service.

As discussed in this NYTIMES article, subsidies to farmers to purchase more water efficient, hence water saving, irrigation systems has encouraged the use of MORE water overall:

Farm Subsidies Leading to More Water Use

From Wyoming to the Texas Panhandle, water tables have fallen 150 feet in some areas — ranging from 15 percent to 75 percent — since the 1950s, scientists say, because the subsidies give farmers the incentive to irrigate more acres of land. Other areas, including several Midwestern states, have also been affected.The Environmental Quality Incentives Program, first authorized in the 1996 farm bill, was supposed to help farmers buy more efficient irrigation equipment — sprinklers and pipelines — to save water.But the new irrigation systems have not helped conserve water supplies, studies show. And researchers believe that the new equipment may be speeding up the depletion of groundwater supplies, which are crucial to agriculture and as a source of drinking water.

This an example of the "Rebound Effect".

In conservation and energy economics, the rebound effect (or take-back effect) refers to the behavioral or other systemic responses to the introduction of new technologies that increase the efficiency of resource use. These responses tend to offset the beneficial effects of the new technology or other measures taken. While the literature on the rebound effect generally focuses on the effect of technological improvements on energy consumption, the theory can also be applied to the use of any natural resource or other input, such as labor. The rebound effect is generally expressed as a ratio of the lost benefit compared to the expected environmental benefit when holding consumption constant. For instance, if a 5% improvement in vehicle fuel efficiency results in only a 2% drop in fuel use, there is a 60% rebound effect (since (5-2)⁄5 = 60%). The 'missing' 3% might have been consumed by driving faster or further than before.

Seems to me the only way this policy would have been effective is if they did not allow farmers to grow more food than before---same fixed land use with less water use equals less water use per acre.

Subsidies for water conservation equipment encourage more production of food not less (or constant).

Good intentions, bad results. Usually we re-think doing things that produce this outcome.

Not with Farm Policy, apparently...

From Wyoming to the Texas Panhandle, water tables have fallen 150 feet in some areas — ranging from 15 percent to 75 percent — since the 1950s, scientists say, because the subsidies give farmers the incentive to irrigate more acres of land. Other areas, including several Midwestern states, have also been affected.The Environmental Quality Incentives Program, first authorized in the 1996 farm bill, was supposed to help farmers buy more efficient irrigation equipment — sprinklers and pipelines — to save water.But the new irrigation systems have not helped conserve water supplies, studies show. And researchers believe that the new equipment may be speeding up the depletion of groundwater supplies, which are crucial to agriculture and as a source of drinking water.

This an example of the "Rebound Effect".

In conservation and energy economics, the rebound effect (or take-back effect) refers to the behavioral or other systemic responses to the introduction of new technologies that increase the efficiency of resource use. These responses tend to offset the beneficial effects of the new technology or other measures taken. While the literature on the rebound effect generally focuses on the effect of technological improvements on energy consumption, the theory can also be applied to the use of any natural resource or other input, such as labor. The rebound effect is generally expressed as a ratio of the lost benefit compared to the expected environmental benefit when holding consumption constant. For instance, if a 5% improvement in vehicle fuel efficiency results in only a 2% drop in fuel use, there is a 60% rebound effect (since (5-2)⁄5 = 60%). The 'missing' 3% might have been consumed by driving faster or further than before.Seems to me the only way this policy would have been effective is if they did not allow farmers to grow more food than before---same fixed land use with less water use equals less water use per acre.

Subsidies for water conservation equipment encourage more production of food not less (or constant).

Good intentions, bad results. Usually we re-think doing things that produce this outcome.

Not with Farm Policy, apparently...

Sunday, June 16, 2013

Update on my Stock Market Activity I do for my Econ classes. See my results since 2006...

I just recently updated my simulated Stock Market activity I do along-side my students for the Personal Finance part of my Economics classes (Sometimes with my AP classes but usually just for my "regular" econ classes.

I have students invest $25,000 in the stock of 5 companies. They choose from a limited list of 100 companies. Students have to calculate all the information you see below and we follow the stocks for a good part of the semester.

As you can see, I started this in 2006 when the economy was doing well, tanked, then "recovered".

For the most part, this is nominal evidence for not giving up and to "Hold em', Not Fold em' "

Focus on my gain and/or loss(es) and Rate of Return. I have only one bad one---Speedway Sports owns some of the most well known NASCAR race tracks. I calculated the total Rate of Return on these stocks at the end.

I have students invest $25,000 in the stock of 5 companies. They choose from a limited list of 100 companies. Students have to calculate all the information you see below and we follow the stocks for a good part of the semester.

As you can see, I started this in 2006 when the economy was doing well, tanked, then "recovered".

For the most part, this is nominal evidence for not giving up and to "Hold em', Not Fold em' "

Focus on my gain and/or loss(es) and Rate of Return. I have only one bad one---Speedway Sports owns some of the most well known NASCAR race tracks. I calculated the total Rate of Return on these stocks at the end.

Subscribe to:

Comments (Atom)