My demand for eggs is almost perfectly Inelastic. This means my quantity demanded pretty much stays the same regardless of the price (or within a pretty wide price range). I don't buy more as the price decreases or less as it increases.

However, I do recognize this is not the case with most people for individual consumption or businesses for commercial use as an input.

So, this article in the Wall Street Journal caught my interest and is game for a little graph-fest..

What Made Egg Prices Soar Nearly 42%?

"...A leading reason for the crack up: U.S. farmers are exporting more eggs to Mexico, eating into supplies for American consumers. The United States’ southern neighbor has been hit by avian influenza, forcing the slaughter of thousands of chickens...."Let's illustrate what is going on here.

First here is the US Market for Eggs in equilibrium before the change cited in the excerpt above.

"Supply*" represent domestic US supply. If US egg producers export more eggs to Mexico, presumably because Mexican consumers and businesses are willing and able to pay a higher price, then there will be FEWER eggs at EVERY PRICE for US consumers:

At the equilibrium price of "Pe" we no longer have an equilibrium market quantity of "Qe" where Quantity Supplied = Quantity Demanded. We are in disequilibrium where Quantity Demanded is GREATER than Quantity Supplied. What is true at "Pe" is going to be true at every other price Quantity Supplied combination on "Supply*". Our market supply curve will shift to the LEFT---"Supply 1".

Our new equilibrium price is going to be "C"...But WHY? Assume the market place does not immediately adjust and the price remains at "Pe". A shortage in the market will emerge equal to the distance between "Qd" and "Qs". Will American egg producers sell all those eggs to citizens of Mexico? No, but they WILL ask Americans to bid against them for the eggs.

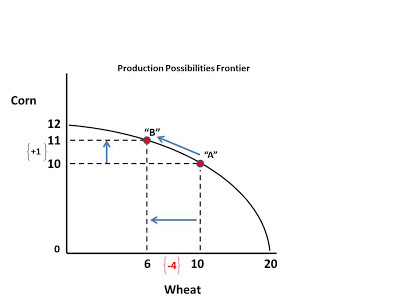

In this next graph, look at the triangle formed by Points "A", "B" and "C".

It is important to understand what happens next to reach a new market equilibrium. As the price is bid up, producers are willing and able to supply and larger quantity to US consumers. However, at a higher price consumers are willing and able to demand a smaller quantity.

We move ALONG our respective Supply Curve ("Supply 1") and ALONG our respective Demand Curve ("Demand*") until we reach new market price "P1" and market quantity "Q1").

Here is our final graph, all cleaned up.

I hope this lesson was Egg-actly what you need to understand a little supply and demand.

Don't "poach" these graphs to use as your own.

"Ummm-Let" me know what you think. :)