Ok, not in the US, but in China. However, it is an important concept that applies to the US banking system, so here we go with a basic primer on it...

One of the monetary policy tools the U.S. Federal Reserve has at its disposal to control the amount of money commercial banks can loan out is called the "Reserve Requirement Ratio". The Reserve Requirement Ratio (aka "RRR") is set by the Federal Reserve. When a bank receives a deposit, it is required to with-hold a percentage of that deposit in its Required Reserves account with the Federal Reserve. The rest of the deposit not subjected to the reserve requirement is then put in the banks "excess reserves" account and may be lent out by the bank in the form of a loan to a customer.

Here is a simple example: I deposit $1,000 into my checking account (aka "Demand Deposit" in banking parlance). Assume the Federal Reserve sets the RRR at 10%. The bank is required to with-hold $100 of my deposit in its Required Reserves account with the Federal Reserve and can deposit up to $900 in its "excess reserves" account. MY bank can then loan out up to $900 to a customer, who in turn, it is assumed, will purchase some new (or perhaps used) good and/or service with that money, hence increasing GDP.

If the Federal Reserve wanted to INCREASE the amount of excess reserves my bank could loan out, then it would DECREASE the RRR. If the RRR was lowered to 5%, then my bank would have to with-hold only $50 from the $1000 deposit and loan out $950, a larger amount than before. The assumption is that a borrower could now purchase $50 MORE in "stuff" than before the change in the RRR, hence a larger increase in GDP. The Federal Reserve might employ this monetary policy tool if the economy were at less than full-employment or recession. More excess reserves =more loans =lower interest rate on those loans= more purchase of GDP = increase in Aggregate Demand = closer to full-employment.

What works forward, also works in reverse. If the Federal Reserve wanted to DECREASE the amount of excess reserve my bank could loan out, it would INCREASE the RRR. If the RRR is increased to 20%, then my bank is required to with-hold $200 of the $1,000 demand deposit and can loan out, in excess reserves, a maximum of $800, which is $100 less than if the RRR were 10%. Now LESS money is available to be loaned out and presumably LESS "stuff" will be purchased, hence GDP would decrease. The Federal Reserve might employ this monetary policy tool if the economy were experiencing inflation. Less excess reserves = fewer loans = higher interest rates on those loans = less purchase of GDP = decrease in Aggregate Demand = closer to full-employment (reducing price level/inflation).

I used the example of only one bank when the Federal Reserve utilizes the monetary policy tool of changing the RRR, but it applies to all banks. In general, what happens at one bank will happen at all banks (in a follow-up blog entry I will change this assumption). So, if the Federal Reserve decreases the RRR all banks will be able to loan out more in excess reserves, which will tend to decrease interest rates as more excess reserves become available to be loaned out, which tends increase the number of loans, which tends to increase the purchase of consumer goods ("C") or investment goods ("I") which tends to increase GDP. I will ignore the effect this has on Net Exports in this example, but suffice it to say, it will also serve to increase GDP. This will help solve recession. I believe you can now follow the logic of what an increase in the RRR will have on the banking system to solve the problem of inflation.

All countries have some semblance of a Central Bank (we call ours "The Federal Reserve Bank of the US"). The Chinese Central Bank just increased its RRR for banks in China, so they have some concerns about inflation and are trying to reign in excess reserves. Click HERE to read all about it.

It is a great time to teach an introductory college level class---MOST of textbook stuff is coming alive in the "real-world"! It is sad to say, but the crappy economy makes it easier to teach economics! (Should I have said that out loud???)

Thank you for visiting my blog. I post things I think will be of interest to high school students and teachers of economics/government/civics etc. Please leave a comment if what you find here has been useful to you. THANK YOU!

Saturday, November 20, 2010

Can you belong to a United Nations Committee representing women AND bar women in your country from partipating in athletics? Yes, you can, if the price is right...

Another story makes me wonder about how the world works---Recently Saudi Arabia was "elected", read that purchased, a seat on the Unitied Nations subcommitte called "UN Women",

(NYTIMES)

Now, this story today in the NYTIMES:

(NYTIMES)

""Most of the 41 board seats were divided among geographic blocs: Asia, Africa, Latin America, Eastern Europe and Western Europe. Six were set aside for major donors, which is how Saudi Arabia gained a seat..."

Now, this story today in the NYTIMES:

""Physical activity of any kind is forbidden in Saudi Arabia’s state-run girls’ schools. Though gyms for women exist in major Saudi cities, they are usually unmarked, so that customers need not fear attracting attention....Saudi Arabia does not permit women to represent it in international athletic competitions, and it is one of only three countries in the world that has yet to send women to the Olympic Games (the others are Qatar and Brunei). Though Saudi Arabia sent an official delegation of male athletes to Singapore for the Youth Olympics, Malhas — the daughter of an accomplished female show jumper, Arwa Mutabagani — had to enter on her own, at her own expense..."On the UN Women's Committee website, they have these as over-arching goals:

"elimination of discrimination against women and girls, empowerment of women, achievement of equality between women and men as partners and beneficiaries of development, human rights, humanitarian action and peace and security."I guess when you purchase a seat on the committee, instead of earning one, it is not necessary to read the "fine print" of the committees mission. I will keep you posted on the major initiatives and reforms the Saudi's put forth on this commitee. You better sleep before you check back. It might be a while...

Friday, November 19, 2010

Today is World Toilet Day! There is still time to join this, umm, movement, so to speak...

World Toilet Day: Top 10 nations lacking toilets

Click HERE for list...

World Toilet Day: Top 10 nations lacking toilets

Click HERE for list...

See a lot of people squatting in the open today? Don't be offended. The so-called "big squat" was held worldwide to coincide with the 10th annual World Toilet Day, an initiative to bring awareness to the need for adequate sanitary facilities.

Every day, some 1.1 billion people go to the bathroom without any type of toilet, according to the World Health Organization. And even with a toilet, facilities are not necessarily sanitary. WaterAid America estimates that roughly 2.5 billion people – nearly 40 percent of the global population – do their business unsafely, often in public spaces.

World Toilet Day is organized by the Singapore-based World Toilet Organization, which has 235 member organizations in 58 countries "working toward eliminating the toilet taboo and delivering sustainable sanitation." Here's a list of the world's worst nations in terms of people lacking access to sanitary facilities.

Homeless Man returns found laptop and $3,300 cash...Do we have it in us to do the same?

Dave Tally, homeless and living on the fringe in Tempe, Ariz., for 11 years, is suddenly the center of attention.

Tally, 49, found a backpack containing $3,300 cash and a laptop and returned it to the owner.

Thursday, November 18, 2010

Wednesday, November 17, 2010

Did I scoop the vaunted Financial Times magazine on Big Mac Inflation in China? Yeah, I think I did...:)

Toot! Toot! (that is me tooting my own horn)....This short piece in the Financial Times, China inflation: The Big Mac indicator, uses the price of a Big Mac in China as a measure of inflationary pressures that may be underway in China.

""More inflation warnings on Wednesday in China, this time from a highly symbolic source. The price of a Big Mac has risen from Rmb14 to Rmb15 at the branch of McDonald’s around the corner from the FT’s Beijing bureau - part of an across-the-board price hike that the US fast food chain blamed on rising costs of ingredients - even if that is still less than two-thirds of the price of a Big Mac in the US...""If they had read THIS blog entry (reproduced below) of mine they would have known this weeks ago...Hey, I am a lowly high school economics teacher...let me have my time in the sun! :)

""Here is the latest "Big Mac Index"(graphic below) produced by The Economist magazine AND one produced in January 2010 (click HERE and HERE for my explanations of how The Big Mac Index works). Look at the cost of a Big Mac in the Euro area and then in China. How has the dollar price of a Big Mac changed in 9 months in each place? In January it took $4.79 to buy one in the Euro area (they took a weighted average) and in October it took $4.84 to buy one. So in dollar terms it became MORE expensive to buy a Big Mac. This implies the dollar lost value, or depreciated, relative to the Euro. Indeed, depreciation relative to the Euro has taken place this year. In China, a Big Mac cost $1.83 in January and in October it cost $2.18 (this is the amount we would give up to buy enough Yuan to purchase a Big Mac in Beijing). This implies the dollar lost value, or depreciated, relative to the Yuan (Chinese currency). SAY WHAT? This is NOT what has been the political discussion as of late. China has been criticized for NOT letting its currency appreciate relative to the dollar (as it SHOULD if it was traded in a flexible FOREX market) which would make its goods and services more expensive for us to buy and our goods and services less expensive for the Chinese to buy US goods and services. This presumably would lead to more balanced trade.

According to the Big Mac Index, from the two different time periods, Yuan appreciation HAS occurred. The dollar price of a Big Mac in China has INCREASED 19.6% ($2.18 minus $1.83 = $.35 divided by $1.83 times 100)!! The following could be happening: the Yuan has significantly appreciated in value, which would be BIG news, or there is Big Mac Inflation in China, or a combination of the two. We certainly have not seen nearly 20% appreciation, so I have to suspect inflation. One product does not make a trend, but is inflation rearing its ugly head in China? I pulled the thread---extra credit for doing the legwork to find out if this is the case... Note: the price of a Big Mac increased in the US, from $3.58 to $3.71, which is an increase of 3.6%. Can we say we have had inflation in the US for the last 9 month? No...so what else might contribute to the price increases in the US AND China for the Great Sandwich?? Extra-Extra Credit!! ""

Tuesday, November 16, 2010

The best of Social Enterprise---Bringing clean water FREE to people who need it and making polluters continents away pay for it. Does it get any better?

A genius idea to provide FREE, CLEAN water to people in poor/developing countries by getting polluters to pay for it, whether they want to or not. It is a positive, if unintended, consequence of Cap and Trade, a policy to reduce carbon emissions world-wide. I encourage you to read the whole article, Clean Water at No Cost? Just Add Carbon Credits, but in a nut shell, here is how it works.

Boiling water in, say, rural Sudan is a very carbon intensive process. It uses firewood in places where trees are in short supply and getting shorter. A company provides simple to use, but not maintenance-free water filters, that help reduce the carbon footprint in Sudan. By reducing carbon emissions in the Sudan, the company earns carbon credits that they in turn sell to polluters in India, China, the US, etc, who are polluting in excess of their alloted emissions. The carbon credits are renewable every year, so the company has an incentive to maintain the existing water filters for free AND expand the use of them. Again, at no cost to the end-user and paid for by polluters continents away.

Regardless of how you may feel about the policy of Cap and Trade, this appears to be a creative way to engage in "Social Enterprise"--- help solve a social problem with market-based principles. We need more of this type of thinking.

Boiling water in, say, rural Sudan is a very carbon intensive process. It uses firewood in places where trees are in short supply and getting shorter. A company provides simple to use, but not maintenance-free water filters, that help reduce the carbon footprint in Sudan. By reducing carbon emissions in the Sudan, the company earns carbon credits that they in turn sell to polluters in India, China, the US, etc, who are polluting in excess of their alloted emissions. The carbon credits are renewable every year, so the company has an incentive to maintain the existing water filters for free AND expand the use of them. Again, at no cost to the end-user and paid for by polluters continents away.

Regardless of how you may feel about the policy of Cap and Trade, this appears to be a creative way to engage in "Social Enterprise"--- help solve a social problem with market-based principles. We need more of this type of thinking.

Monday, November 15, 2010

A Medal of Honor will be presented at the White House tomorrow...Enclosed is a 60 Minutes segment on his actions and a brief description of the event(s) that lead to the awarding of this Medal...

The official Medal of Honor Citation will not be known until it is read at the ceremony on Nov 16th, 2010, but here is information contained in a White House press release about his acts of heroism...

Then-Specialist Salvatore A. Giunta distinguished himself by acts of gallantry at the risk of his life above and beyond the call of duty while serving as a rifle team leader with Company B, 2d Battalion (Airborne), 503d Infantry Regiment during combat operations against an armed enemy in the Korengal Valley, Afghanistan on October 25, 2007. When an insurgent force ambush split Specialist Giunta's squad into two groups, he exposed himself to enemy fire to pull a comrade back to cover. Later, while engaging the enemy and attempting to link up with the rest of his squad, Specialist Giunta noticed two insurgents carrying away a fellow soldier. He immediately engaged the enemy, killing one and wounding the other, and provided medical aid to his wounded comrade while the rest of his squad caught up and provided security. His courage and leadership while under extreme enemy fire were integral to his platoon's ability to defeat an enemy ambush and recover a fellow American paratrooper from enemy hands.I have had the distinct honor of holding Master Sergeant Roy P. Benavidez's Medal of Honor. His son brought it to a program I organized at my childs elementary school many years ago....Below is his official Medal of Honor Citation (from The Congressional Medal of Honor Society). Please read---you will think this is fiction, but it was all too real...

""Master Sergeant (then Staff Sergeant) Roy P. Benavidez United States Army, who distinguished himself by a series of daring and extremely valorous actions on 2 May 1968 while assigned to Detachment B56, 5th Special Forces Group (Airborne), 1st Special Forces, Republic of Vietnam. On the morning of 2 May 1968, a 12-man Special Forces Reconnaissance Team was inserted by helicopters in a dense jungle area west of Loc Ninh, Vietnam to gather intelligence information about confirmed large-scale enemy activity. This area was controlled and routinely patrolled by the North Vietnamese Army. After a short period of time on the ground, the team met heavy enemy resistance, and requested emergency extraction. Three helicopters attempted extraction, but were unable to land due to intense enemy small arms and anti-aircraft fire. Sergeant Benavidez was at the Forward Operating Base in Loc Ninh monitoring the operation by radio when these helicopters returned to off-load wounded crewmembers and to assess aircraft damage. Sergeant Benavidez voluntarily boarded a returning aircraft to assist in another extraction attempt. Realizing that all the team members were either dead or wounded and unable to move to the pickup zone, he directed the aircraft to a nearby clearing where he jumped from the hovering helicopter, and ran approximately 75 meters under withering small arms fire to the crippled team. Prior to reaching the team's position he was wounded in his right leg, face, and head. Despite these painful injuries, he took charge, repositioning the team members and directing their fire to facilitate the landing of an extraction aircraft, and the loading of wounded and dead team members. He then threw smoke canisters to direct the aircraft to the team's position. Despite his severe wounds and under intense enemy fire, he carried and dragged half of the wounded team members to the awaiting aircraft. He then provided protective fire by running alongside the aircraft as it moved to pick up the remaining team members. As the enemy's fire intensified, he hurried to recover the body and classified documents on the dead team leader. When he reached the leader's body, Sergeant Benavidez was severely wounded by small arms fire in the abdomen and grenade fragments in his back. At nearly the same moment, the aircraft pilot was mortally wounded, and his helicopter crashed. Although in extremely critical condition due to his multiple wounds, Sergeant Benavidez secured the classified documents and made his way back to the wreckage, where he aided the wounded out of the overturned aircraft, and gathered the stunned survivors into a defensive perimeter. Under increasing enemy automatic weapons and grenade fire, he moved around the perimeter distributing water and ammunition to his weary men, reinstilling in them a will to live and fight. Facing a buildup of enemy opposition with a beleaguered team, Sergeant Benavidez mustered his strength, began calling in tactical air strikes and directed the fire from supporting gunships to suppress the enemy's fire and so permit another extraction attempt. He was wounded again in his thigh by small arms fire while administering first aid to a wounded team member just before another extraction helicopter was able to land. His indomitable spirit kept him going as he began to ferry his comrades to the craft. On his second trip with the wounded, he was clubbed from additional wounds to his head and arms before killing his adversary. He then continued under devastating fire to carry the wounded to the helicopter. Upon reaching the aircraft, he spotted and killed two enemy soldiers who were rushing the craft from an angle that prevented the aircraft door gunner from firing upon them. With little strength remaining, he made one last trip to the perimeter to ensure that all classified material had been collected or destroyed, and to bring in the remaining wounded. Only then, in extremely serious condition from numerous wounds and loss of blood, did he allow himself to be pulled into the extraction aircraft. Sergeant Benavidez' gallant choice to join voluntarily his comrades who were in critical straits, to expose himself constantly to withering enemy fire, and his refusal to be stopped despite numerous severe wounds, saved the lives of at least eight men. His fearless personal leadership, tenacious devotion to duty, and extremely valorous actions in the face of overwhelming odds were in keeping with the highest traditions of the military service, and reflect the utmost credit on him and the United States Army.""

What do two kids selling cookies in a park have to do with the US status in the world of places to do business? Maybe nothing BUT maybe everything...

I often wonder if America is losing its entrepreneurial edge. We foster this spirit in kids and hope it carries through to adulthood. Below is an article on how one town councilman, who I am sure has uttered the phrase "do you know who I am?" more than once, called the police on the young men. The graph below is from today's WSJ on "The Best Country to Start a Business"...We are number 3. Is that good enough? I know, this is VERY anectdotal evidence, but is there a trend in the US of hostility towards entrepreneurship? What do you think?

New Castle councilman calls cops on boys' cupcake sale

""When Andrew DeMarchis and Kevin Graff, two 13-year-olds from Chappaqua's Seven Bridges Middle School, set up shop at Gedney Park on a fall weekend last month, they were expecting a tidy profit.

Instead, the two wannabe entrepreneurs selling cupcakes, cookies, brownies and Rice Krispie treats baked by them for $1 apiece got a taste of cold, hard bureaucracy .

New Castle Councilman Michael Wolfensohn came upon the sale and called the cops on the kids for operating without a license.

The boys' parents are incensed and can't believe a Town Board member would handle the situation that way.

"I am shocked and sad for the boys. It was such a great idea, and they worked hard at it," said Laura Graff, Kevin's mother. "But then some Town Board member decided to get on his high horse and wreck their dreams."""

New Castle councilman calls cops on boys' cupcake sale

""When Andrew DeMarchis and Kevin Graff, two 13-year-olds from Chappaqua's Seven Bridges Middle School, set up shop at Gedney Park on a fall weekend last month, they were expecting a tidy profit.

Instead, the two wannabe entrepreneurs selling cupcakes, cookies, brownies and Rice Krispie treats baked by them for $1 apiece got a taste of cold, hard bureaucracy .

New Castle Councilman Michael Wolfensohn came upon the sale and called the cops on the kids for operating without a license.

The boys' parents are incensed and can't believe a Town Board member would handle the situation that way.

"I am shocked and sad for the boys. It was such a great idea, and they worked hard at it," said Laura Graff, Kevin's mother. "But then some Town Board member decided to get on his high horse and wreck their dreams."""

|

| Wall Street Journal |

Sunday, November 14, 2010

Analyze this graph for me. Why have 16 to 19 year olds been dropping out of the labor force so dramtically for the last 10 years? Any ideas?

I am curious about this graph, especially the purple and red lines. The graph shows the Labor Force Participation Rate (for each group, the number employed or are who are looking for a job, divided by the number of people in that age group times 100) for different age groups. The red line is for ages 16 to 19 and the puple line is for ages 55 and over. They intersect in late 2009. The slope of the line becomes much steeper for the 16 to 19 age group, indicating a rapidly declining participation rate for this age group. Now, go back to when this trend started to appear, approximately January 2001. At this point, we can see there is a rather dramatic downward trend in the 16-19 participation rate. Why did this happen? What changed in our economy/society to create this trend? I have my guess, but will give extra credit for good responses.

|

| Calculate Risk |

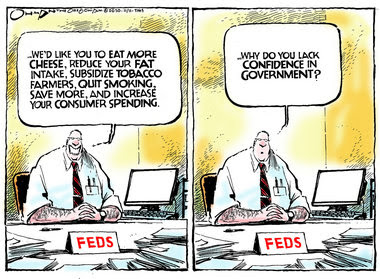

Political Cartoon in NYTIMES that sums up a couple of blog entries I made this week. Perhaps I am getting too cynical...

Subscribe to:

Posts (Atom)