""On Jan. 1, 2011, the oldest Baby Boomers will turn 65. Every day for the next 19 years, about 10,000 more will cross that threshold. By 2030, when all Baby Boomers will have turned 65, fully 18% of the nation's population will be at least that age, according to Pew Research Center population projections. Today, just 13% of Americans are ages 65 and older.""Pew Research CenterNew Year, same problem with long-run Social Security and Medicare sustainability...Is THIS the year these programs will be addressed with the seriousness they merit? That is my wish for the New Year---or to lose 25 pounds, whichever comes first. They both face insurmoutable odds... :)

Thank you for visiting my blog. I post things I think will be of interest to high school students and teachers of economics/government/civics etc. Please leave a comment if what you find here has been useful to you. THANK YOU!

Friday, December 31, 2010

My wish for the New Year....YES, it is related to economics...Don't judge me...

Food for thought as we pass into the New Year...

Thursday, December 30, 2010

If you shovel snow from a public parking space, can you "save" that space for yourself? Show your work for full credit...

Interesting how circumstances can change the way people think about public property. Just because someone shoveled a space they feel entitled to it. Perhaps these residents are using this passage from John Locke "Two Treatises on Government" to justify their attempt at co-opting of public property:

""The labour of his body, and the work of his hands, we may say, are properly his. Whatsoever then he removes out of the state that nature hath provided, and left it in, he hath mixed his labour with, and joined to it something that is his own, and thereby makes it his property. It being by him removed from the common state nature hath placed it in, it hath by this labour something annexed to it, that excludes the common right of other men: for this labour being the unquestionable property of the labourer, no man but he can have a right to what that is once joined to, at least where there is enough, and as good, left in common for others.""However, I don't believe Locke would not approve of using his words in this case with land legally appropriated for use "in the common"--it is no longer "in the state of nature"--or is it? If government fails in its duty to preserve the property in common (not plowing the road for the safety/convenience of its citizens),should/could it not be considered plunged back into the state of nature? It would be an interesting episode of COPS to see a resident use Locke to justify his place-holding of a public parking spot...I am guessing that would end with a tasing.

Wind energy is for the birds! Actually it is AGAINST the birds! I thought Wind Energy was clean...Sounds kinda nasty to me...

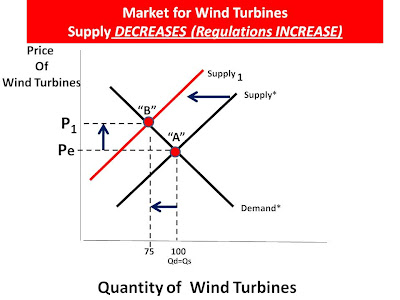

Wind energy is already expensive to produce (per kilowatt hour, minus the subsidies it recieves) and if well-intentioned interest groups have any input, it will get more expensive. The problem: Birds are victims of the spinning blades and the American Bird Conservatory would like to require additional environmental impact studies and additional regulations imposed to be more "bird-friendly".

From American Bird Conservatory:

From American Bird Conservatory:

""Wind power has the ability to be a green, bird-friendly form of power generation, but can also adversely affect birds. Birds can die in collisions with the turbine blades (up to 14 birds per megawatt per year in the U.S., with a median rate of around 2.2 birds/MW/Yr according to industry estimates), towers, power lines, or related structures, and can also be impacted through habitat destruction from the siting of turbines, power lines, and access roads. Some birds, such as sage-grouse are particularly sensitive to the presence of turbines, and can be scared away from their breeding grounds several miles away from a wind farm.Cost of production is a determinant of Supply. When additional costs are incurred complying with regulations, ceterus paribus , then supply decreases (shifts left). Moving up to the left along our demand curve, from Point "A" to Point "B", we reach a new higher market price ("P1) and a lower market quantity ("75"). (HT: Environmental Economics)

Potentially all night-migrating songbirds are at risk of colliding with wind turbines, as are raptors and waterbirds when wind farms are sited in areas they frequent, particularly wildlife refuges. Greater Sage-Grouse are particularly sensitive to the presence of wind turbines near their breeding grounds.

American Bird Conservancy supports alternative energy sources, including wind power, but emphasizes that prior to the approval and implementation of new wind energy projects, potential risks to birds should be evaluated through site analyses, including assessments of bird abundance, timing, and magnitude of migration, and habitat use patterns.

Wind energy project location, design, operation, and lighting should be carefully evaluated to prevent bird mortality, as well as adverse impacts caused by habitat fragmentation, disturbance, and site avoidance. Wind power projects should be sited on areas with poor habitat where possible, such as heavily disturbed lands, (e.g. intensive agriculture). Excellent guidelines to prevent adverse impacts of wind power generation on birds are already in existence, but these need to be turned into mandatory regulations. Read ABC’s complete position statement on wind.

Tuesday, December 28, 2010

Good ol' Days--Part 3---Shipping costs in 1960 relative to today...I was born too early!! The good ol' days are today...

Professor Mark Perry at Carpe Diem has done a series of "then and now" price comparisons using a terrific online resource from Radio Shack. They have put the ENTIRE contents of decades worth of their catalogs online. It is really fun to look at the catalog from my (or your) birth year. The pictures are fun to look at and for those of you who are really into the technical aspects of consumer electronics will be AMAZED at the detail they go into with each good. Don't see that anymore....

Dr Perry has focused on final goods, but I was curious about the transportation costs of getting a good delivered to you. Below you will find the table from the 1960 catalog (my birth year). If I wanted to buy something that weighed 11 pounds (easy to do the math) and have it shipped to me it would have cost $6.30 in 1960 (1st pound $.70 and each additional pound $.56). I also used "Zone 5" estimating that the package would travel 1000 miles to get to me. Using an inflation calculator, that would be $46.57 in TODAY's dollars! WOW!

From the US Postal Service website, I found the following:

Just guessing, but an 11 pound item would probably fit in either of the boxes on the right. These are retail prices, so a large company like radio shack probably gets a significant price break on it shipping costs from the USPS. Shipping costs are 3 to 4 (maybe 5) times cheaper today than in 1960.

Not only have the goods we buy today gone down in price but the transportation costs to get them to us have decreased significantly as well. In the age of a global supply chain, it seems you could not have one without the other...

Dr Perry has focused on final goods, but I was curious about the transportation costs of getting a good delivered to you. Below you will find the table from the 1960 catalog (my birth year). If I wanted to buy something that weighed 11 pounds (easy to do the math) and have it shipped to me it would have cost $6.30 in 1960 (1st pound $.70 and each additional pound $.56). I also used "Zone 5" estimating that the package would travel 1000 miles to get to me. Using an inflation calculator, that would be $46.57 in TODAY's dollars! WOW!

|

| Radio Shack Catalog--1960 |

Just guessing, but an 11 pound item would probably fit in either of the boxes on the right. These are retail prices, so a large company like radio shack probably gets a significant price break on it shipping costs from the USPS. Shipping costs are 3 to 4 (maybe 5) times cheaper today than in 1960.

Not only have the goods we buy today gone down in price but the transportation costs to get them to us have decreased significantly as well. In the age of a global supply chain, it seems you could not have one without the other...

Who is more selfish---Senior Citizens who won't take reduced benefits to help young people financially, or young people who won't pay more taxes to help old people financially? Good luck with that question...

My students over the last few years have heard something very similar in my lectures, but I have always prefaced it by suggesting this is not something you can say out loud (outside of an academic setting) because these two programs (Social Security and Medicare) are so sacred and personal. Up to this point, politically, they are off-limits to any significant change. However, they are the "elephants in the room" that are moving from the recliner to the couch and will soon need a sectional sofa to fit its ever expanding self...

WSJ: Notable and Quotable-

Robert Samualson

(1) Ask any grand-parent if they would do anything for their grand-children they would say yes...Then why can't we cut Social Security and Medicare benefits to that group of people?

(2) Ask any Grand-child if they would do anything for their grand-parents they would say yes...Then why can't we raise the Social Security and Medicare taxes on that group of people.

WSJ: Notable and Quotable-

Robert Samualson

""There has been much brave talk recently, from Republicans and Democrats alike, about reducing budget deficits and controlling government spending. The trouble is that hardly anyone admits that accomplishing these goals must include making significant cuts in Social Security and Medicare benefits for baby boomers. . . .Doing so, it's argued, would be "unfair" to people who had planned retirements based on existing programs. Well, yes, it would be unfair. . . But not making cuts would also be unfair to younger generations and the nation's future. . . . The old deserve dignity, but the young deserve hope. The passive acceptance of the status quo is the path of least resistance—and a formula for national decline.""What do you think of the following two premises and questions? Are there any alternatives? If so, Washington needs to hear them.... :)

(1) Ask any grand-parent if they would do anything for their grand-children they would say yes...Then why can't we cut Social Security and Medicare benefits to that group of people?

(2) Ask any Grand-child if they would do anything for their grand-parents they would say yes...Then why can't we raise the Social Security and Medicare taxes on that group of people.

What South Korean students are doing on Christmas Break vs. What American students are doing....

"What did you learn over Christmas Break?"

South Korean student answer: "How to dominate the world!"

American student answer: "Break was too short! It is not fair!"

South Korean student answer: "How to dominate the world!"

|

| South Korean elementary and middle school students rub their bodies with the snow during a winter military camp for kids at the Cheongryong Self-denial Training Camp on Daebu Island in Ansan. Some 50 students took part in the three-day camp as a way to mentally and physically strengthen themselves. Baltimore Sun. |

|

| American students practicing for a "really cool" Flash Mob to be performed at the mall, or re-enacting the last episode of "Glee" or Some-Such... |

Does DisneyWorld fascinate you? Nice NYTIMES article on how they monitor lines and wait times...It is scary how efficient they are without you knowing it!

I am a recent convert to the greatness of DisneyWorld...As an Economics teacher, what particularly interests me is the "magic" and how it is created and maintained. Whenever I go there, I "look at the trees instead of forest" and try to pinpoint all the nuances of how Disney Inc. tries to manipulate us into having the experience they want us to have. Some would say that takes the fun out of it...Hey, I say it puts the fun INTO it!!

If you are interested in the behind the scene machinations of how they monitor lines and get people moving without their explicit knowledge, then it will be worth your time to read the whole article. The study of lines, or "queues", are the subject of much social science research. Businesses are always looking for ways to shorten customers wait times, make that time less of a burden on customers, and/or try to wring out additional sales and profit from that wait time....Good stuff!

NYTIMES: Disney Tackles Major Theme Park Problem: Lines

If you are interested in the behind the scene machinations of how they monitor lines and get people moving without their explicit knowledge, then it will be worth your time to read the whole article. The study of lines, or "queues", are the subject of much social science research. Businesses are always looking for ways to shorten customers wait times, make that time less of a burden on customers, and/or try to wring out additional sales and profit from that wait time....Good stuff!

NYTIMES: Disney Tackles Major Theme Park Problem: Lines

""Deep in the bowels of Walt Disney World, inside an underground bunker called the Disney Operational Command Center, technicians know that you are standing in line and that you are most likely annoyed about it. Their clandestine mission: to get you to the fun faster....And so it has spent the last year outfitting an underground, nerve center to address that most low-tech of problems, the wait. Located under Cinderella Castle, the new center uses video cameras, computer programs, digital park maps and other whiz-bang tools to spot gridlock before it forms and deploy countermeasures in real time. ""

Sunday, December 26, 2010

Do you want your life to be happier? You can! All you have to do is turn 50. Here is a graph to prove it...

Well, as you can see, turning 26 will do it too, but then is goes back downhill...Although I am only 8 months into my 50th year, I find some validity in the graph below. Acceptance of things I cannot change has gone a long way in giving me piece of mind...No mid-life crisis for me, unless you consider recently I have not worn my seatbelt when I am in my car alone and take the short trip to the grocery store...Ahhh, the freedom!! I think I am going to be good from now on... :)

""When people start out on adult life, they are, on average, pretty cheerful. Things go downhill from youth to middle age until they reach a nadir commonly known as the mid-life crisis. So far, so familiar. The surprising part happens after that. Although as people move towards old age they lose things they treasure—vitality, mental sharpness and looks—they also gain what people spend their lives pursuing: happiness. This curious finding has emerged from a new branch of economics that seeks a more satisfactory measure than money of human well-being. Conventional economics uses money as a proxy for utility—the dismal way in which the discipline talks about happiness. But some economists, unconvinced that there is a direct relationship between money and well-being, have decided to go to the nub of the matter and measure happiness itself...Read Full Artice HERE

|

| The Economist |

""The Good ol' Days""-- Part 2...

(See Part 1 HERE)...Mark Perry at Carpe Diem gives further evidence that the "good ol' days" are TODAY, and as someone born in 1960 I tend to agree. What gives money its value to the great un-washed is what we can exchange it for in the quantity and quality of goods/services. You can extend this analysis to consumer goods across the board IF those goods are (1) bought in competitive markets domestically that are subjected to limited government interference through significant market distorting subsidies (private and public goods, i.e. education, medical care) and (2) subjected to international trade and competition. Please visit this ENTRY many active links in this blog entry I did not include...

""Here's another comparison of consumer purchasing power in the 1960s versus today, based on the time cost of common household appliances like a kitchen oven. The Sears Kenmore oven pictured below retailed for $330 in 1966, which would represent 121.3 hours of work (about three weeks) at the average hourly wage in that year (ignoring taxes).

At the current average hourly wage of $19.10, today's average consumer would earn a little more than $2,300 working 121.3 hours, and would be able to furnish their entire kitchen with the new appliances pictured below (click to enlarge) from Best Buy including a high-efficiency front-loading washing machine, super capacity gas dryer, 30-inch gas stove, 8.8 cubic feet chest freezer, 16.5 cubic foot refrigerator, dishwasher, mid-size microwave and blender:

Measured by what is ultimately most important, the value of our time, household appliances keep getting cheaper and cheaper, thanks to innovation, technology improvements, supply chain efficiencies, increases in productivity and other market-driven efficiencies that drive prices lower and lower year by year. As much as we hear about declines in median income, economic stagnation, the disappearance of the middle class, falling real wages, increasing income inequality, the data tell a much different story: The rich are getting richer and the poor are getting richer.''

Friday, December 24, 2010

Which Christmas would you prefer? The one from the good ol' days of 1964 or the Malthusian days of 2010?..The choice is easy for me.

Ahhh...the good ol' days of the 1960's!! Ummm, not so much. I think we suffer from a collective case of "good old day" syndrome. You tell me, would you rather have the Christmas of 1964 or 2010? (HT: Carpe Diem)

I remember my "rich" friends getting a T.V. like either one of these! The small white boxes on the picture show the equivalent of $749 and $799 in 1964 to today's dollars--$$5,300 and $5,650, respectively. In other words, factoring in inflation, the purchasing power of $749 in 1964 is equivalent to the purchasing power of $5,300 today. Another way of looking at it, is that 1964 TV would cost you $5,300! Yikes! The true test of the value of money is what it can buy. Below are some examples of bundles of goods you could buy today with the equivalent of 1964 dollars. I can buy ALL these today AND a better TV to boot, than I could in 1964!:

|

| Carpe Diem |

|

| Carpe Diem |

AND

|

| Carpe Diem |

The ONLY reason I would choose 1964 is because I would only be 4 years old...Other than that, well...Perhaps THESE are the good ol' days!

Source CARPE DIEM:

""Bottom Line: For a consumer or household spending $750 in 1964, all they would have been able to afford was a console color TV from the Sears Christmas catalog. A consumer or household spending that same amount of inflation-adjusted dollars today ($5,300) would be able buy able to furnish their entire kitchen with 8 brand-new appliances (refrigerator, freezer, dishwasher, range, washer, dryer, microwave and blender) and buy 9 state-of-the-art electronic items (laptop, GPS, camera, home theater, plasma HDTV, iPod Touch, Blu-ray player, 300-CD changer and a Tivo recorder). And of course, even a billionaire in 1964 wouldn't have been able to purchase many of the items that even a teenager can afford today, e.g. laptop, GPS, digital camera.As much as we might complain about high unemployment, high taxes, a huge deficit, we have a lot to be thankful for, and we've made a lot of economic progress since the 1960s as the example above illustrates, thanks to the "magic of the marketplace."""

Thursday, December 23, 2010

How much is the Federal and State tax on a gallon of gas? Oh, you did not know taxes were already included...Find out how much you pay relative to other states...

Gasoline prices are inching up lately due to the increase in the price of crude oil. The media often reports regional differences in gas prices, but seldom goes deeper in examining why. One reason is differences in State gas taxes assessed per gallon of gas. Embedded in the price of a gallon of gas at the pump is a Federal gas tax of $.18 ("18 cents") plus the State tax. This link Gasoline prices and taxes by state will take you to an interactive graph showing each States retail price of gas AND the State tax per gallon (you have to subtract 18.4 cents from the total to get the state tax). Texas and Californial have a pretty large difference in retail price--$2.85 vs $3.28 respectively. The State gas tax in Texas is $.20 and the State tax in California is $.461, a difference of $.261. If we factor out the difference in State taxes, we find the "real" price of gas in California is $3.02 ($3.28 minus $.261) compared to $2.85 in Texas. Still higher, but not as dramatic. What else could account for the relative difference in prices?

Now, this does not make motorists in California feel any better but it does make the gas price comparison a little more honest.

Upon 30 seconds of reflection, I find at least one hole in my analysis (a pretty big one)....Look at the graph and see if you can find out what I missed...EXTRA CREDIT on the final is at stake!!!

Now, this does not make motorists in California feel any better but it does make the gas price comparison a little more honest.

Upon 30 seconds of reflection, I find at least one hole in my analysis (a pretty big one)....Look at the graph and see if you can find out what I missed...EXTRA CREDIT on the final is at stake!!!

Private Property Rights---BORING!! Well, not so much for people without them...They would like just a little of what rights you enjoy today...

In the span of two days the articles linked below have shone a light on how the lack of enforceable private property rights in developing countries have harmed large groups of people. This is a widespread problem in Africa and other developing countries and it is commonly cited as a (the?) major, over-arching reason why it makes it so difficult for these countries to experience significant economic progress for the masses.

WSJ: Tullow Oil's Ambitions in Uganda Entangle Company in Land Dispute

NY TIMES: African Farmers Displaced as Investors Move In

Here are a few excerpts that illustrate the issue/problem. Notice the commonalities:

Hernado de Soto, in his great book "The Mystery of Capital--Why Capitalism Triumphs in the West and Fails Everywhere Else"", gives as keen an insight on this issue and is considered an authority on the subject. He sees private property as a generator of physical and financial capital that one can parlay into more physical and financial captial.

So, if you own a house, car, business, or other physical/financial asset and you don't fear someone can arbitrarily take it away from you, then you should thank the private property rights our major institutions (executive, legislative, judicial) still protect...many in the world envy you right now...

WSJ: Tullow Oil's Ambitions in Uganda Entangle Company in Land Dispute

NY TIMES: African Farmers Displaced as Investors Move In

Here are a few excerpts that illustrate the issue/problem. Notice the commonalities:

""The half-dozen strangers who descended on this remote West African village brought its hand-to-mouth farmers alarming news: their humble fields, tilled from one generation to the next, were now controlled by Libya’s leader, Col. Muammar el-Qaddafi, and the farmers would all have to leave."" WSJFrom our Euro-centric point of view, it seems like a relatively simple thing to do. Advanced economy's of the developed world have mastered the art of establishing and maintaining private property rights to the extent that we hardly give it second thought and it is woven into the fabric of our economic DNA. How come we can do it, but much of the rest of the world can't or won't? Ownership rights give one a sense of security and it allows you to benefit (ok, profit) from that ownership. Ownership rights privide the incentive to maintain and improve the asset for (1) your own private benefit, which in turn improves the community you live in and (2) makes it more attractive to someone else who may want to acquire ownership in your asset at a fair market price. Without property rights that are enforced by the rule of law, then the incentive to do these two things, in large part, disappears.

""Sekou Traoré, 69, a village elder, was dumbfounded when government officials said last year that Libya now controlled his land and began measuring the fields. He had always considered it his own, passed down from grandfather to father to son.""WSJ

""A battle is brewing over oil-rich land licensed by Uganda's government to Tullow Oil PLC, entangling the U.K. company in a conflict between nomadic livestock herders and indigenous communities. In recent days, Uganda's army had begun enforcing an order from President Yoweri Museveni to remove the herders. They were forced off the land with about 10,000 head of cattle and not provided with an alternative place to settle, according to security officers in the Bulisa and Hoima districts. "" NYTIMES

""The legal spat echoes similar conflicts over land and resources in other developing countries, from Africa to Asia. Governments sometimes sell land to companies where local farmers have lived for generations, with or without any record of property ownership."" NYTIMES

""Like many other indigenous people in the area, Mr. Alisemera said he inherited his land from his ancestors. Yet with the discovery of oil and an influx of cattle herders, his hold on the land is threatened. Many herders have acquired title deeds in an effort to bolster bids for compensation if they are asked to leave."NYTIMES

Hernado de Soto, in his great book "The Mystery of Capital--Why Capitalism Triumphs in the West and Fails Everywhere Else"", gives as keen an insight on this issue and is considered an authority on the subject. He sees private property as a generator of physical and financial capital that one can parlay into more physical and financial captial.

""...But they hold these resources in defective forms: houses built on land whose ownership rights are not adequately recorded, unincorporated businesses with undefined liability, industries located where financiers and investors cannot see them. Because the rights to these possessions are not adequately documented, these assets cannot readily be turned into capital, cannot be traded outside of narrow local circles where people know and trust each other, cannot be used as collateral for a loan, and cannot be used as a share against an investment....""In the US and other developed countries this confiscating of property with no due process rarely happens. While not perfect, we do have the institutions (the legal system) to help us fend off land grabs, from the government or other elites, that are so common in developing countries. Until private property reforms are made and enforced by an independent legal system, places and incidents like the ones described above will have very limited progress.

""The poor inhabitants of these nations —the overwhelming majority— do have things, but they lack the process to represent their property and create capital. They have houses but not titles; crops but not deeds; businesses but not statutes of incorporation. It is the unavailability of these essential representations that explains why people who have adapted every other Western invention, from the paper clip to the nuclear reactor, have not been able to produce sufficient capital to make their domestic capitalism work.""

So, if you own a house, car, business, or other physical/financial asset and you don't fear someone can arbitrarily take it away from you, then you should thank the private property rights our major institutions (executive, legislative, judicial) still protect...many in the world envy you right now...

Wednesday, December 22, 2010

Want to create a revolution in Iran? It is not very romantic, but taking away subsidies might do it...

LA TIMES: Prices in Iran rise after lifting of subsidies

The first graph shows the pre-subsidy market equilibrium for __??___(insert any of the goods/services mentioned in the article).

If the government offers the subsidy to the producer this, in effect, decreases their cost of producing. Relative to ANY point on supply curve "S w/o subsidy" the cost of producing is going to be "P w/o subsidy PLUS the Subsidy". See graph below.

If we connect our new points, we find our market supply curve has shifted to the RIGHT. Shown below as "S w/Subsidy". At any price the quantity supplied is going to be GREATER than it was relative to "S w/o Subsidy".

Only ONE of these points on "S w/Subsidy" intersects with the existing demand curve (D*)--Point "B". If we connect and re-label our equilibrium points, we see we have a market equilibrium price of "P1 W/Subsidy" and market quantity "Q1". Illustrated below:

Now, at Point "B" we have market quantity "Q1". This implies Quantity Demanded = Quantity Supplied. True enough. But to see the effect of the subsidy, look at what previously suppliers would have had to receive to supply "Q1". If we take the subsidy away, we see producers would have required "P2" for that quantity supplied. See Point "C" on the graph below:

The subsidy reduced the market price to consumers to "P1 w/subsidy". When the government rescinded the subsidies, "S w/Subsidy" snapped back to "S w/o Subsidy" very quickly. We returned to the original price and market quantity.

I hope this helps in understanding the current social unrest in Iran. It is important because with all the other problems people have had lately with the ruling regime there, this could be a tipping point for many who were not interested in participating in the protests earlier in the year. As I am fond of saying, look at the root cause of most wars, revolutions, or other manifestations of social unrest, there is usually an everyday economic problem associated with it...

""The Iranian government's removal of decades-old subsidies for food and energy in an attempt to boost its troubled economy has spurred price increases on everything from fruit and vegetables to gasoline, generated work stoppages and emboldened the political opposition....""A government can choose to subsidize the production (supply) or consumption (demand) of a good and/or service. From the tone of the article I am going to assume the Iranian government provides the subsidy to the producers/suppliers of goods and/or services. A subsidy is a cash transfer (or tax credit) intended to reduce the cost of producing a good/service for the producer with the goal of reducing the price to the consumer. To see how this occurs, let's look at it graphically.

The first graph shows the pre-subsidy market equilibrium for __??___(insert any of the goods/services mentioned in the article).

If the government offers the subsidy to the producer this, in effect, decreases their cost of producing. Relative to ANY point on supply curve "S w/o subsidy" the cost of producing is going to be "P w/o subsidy PLUS the Subsidy". See graph below.

If we connect our new points, we find our market supply curve has shifted to the RIGHT. Shown below as "S w/Subsidy". At any price the quantity supplied is going to be GREATER than it was relative to "S w/o Subsidy".

Only ONE of these points on "S w/Subsidy" intersects with the existing demand curve (D*)--Point "B". If we connect and re-label our equilibrium points, we see we have a market equilibrium price of "P1 W/Subsidy" and market quantity "Q1". Illustrated below:

Now, at Point "B" we have market quantity "Q1". This implies Quantity Demanded = Quantity Supplied. True enough. But to see the effect of the subsidy, look at what previously suppliers would have had to receive to supply "Q1". If we take the subsidy away, we see producers would have required "P2" for that quantity supplied. See Point "C" on the graph below:

The subsidy reduced the market price to consumers to "P1 w/subsidy". When the government rescinded the subsidies, "S w/Subsidy" snapped back to "S w/o Subsidy" very quickly. We returned to the original price and market quantity.

I hope this helps in understanding the current social unrest in Iran. It is important because with all the other problems people have had lately with the ruling regime there, this could be a tipping point for many who were not interested in participating in the protests earlier in the year. As I am fond of saying, look at the root cause of most wars, revolutions, or other manifestations of social unrest, there is usually an everyday economic problem associated with it...

Nice interactive graph on the prevalence of smoking in the US...PLEASE tell me WHY anyone under the age of 30 would freely choose to smoke. I really would like to know...

Smoking in America---Go HERE to view this interactive map on the prevalence of smoking in the US by frequency and age groups. In this day and age, with all the available information, I do not understand why anyone under the age of 30 would smoke. I am not even factoring in the price of cigarettes, which by itself should be a deterrent...

|

| Slate |

Tuesday, December 21, 2010

Graph comparing US Defense spending with other countries...Is there room to cut, and is there room for other countries to pull their own weight? Just askin'...

Is there room to cut defense spending? I just sayin'...Why will it not be cut, in my humble opinion? Defense spending, MORE than any other industry, affects EVERY Congressional district in the US. Whether it is a Liberal or Conservative district it does not matter. Politicians are of the same mind on this one, regardless of political ideology. I am open to contrarian opinions. Where am I going wrong?

Why The United States Of America Is Broke

I don't endorse the political view on the war(s) that accompanies this graph (below). I am neutral on that point for the purposes of this posting. However, to put the Defense Dept budget off-limits for a cost-benefit analysis is something I don't endorse. Everything should be scrutinized for WTF! (Waste, Theft, Fraud---what were YOU thinking....)...

Why The United States Of America Is Broke

|

| BusinessInsider |

I don't endorse the political view on the war(s) that accompanies this graph (below). I am neutral on that point for the purposes of this posting. However, to put the Defense Dept budget off-limits for a cost-benefit analysis is something I don't endorse. Everything should be scrutinized for WTF! (Waste, Theft, Fraud---what were YOU thinking....)...

""Greedy politicians willing to accept bribes to get reelected, support massive defense budgets. Defense contractors as well as those receiving handouts from defense contractors label anyone not in favor of wars and massive military spending as "soft on defense". With massive fearmongering campaigns, including pictures of nuclear bombs going off, those organizations are able to whip up public sentiment to do whatever they want, which essentially is to spend more on defense. Every soldier in another country is another soldier that needs to be equipped. At election time defense contractors donate massively to candidates willing to waste more money on needless wars that do not need to be fought. Over time, legislative bodies in general get packed with politicians accepting bribes (campaign contributions) from warmongers.

Unfortunately, "compromise" is such that taxpayers get stuck with the worst of both. We have baseless wars and untenable defense spending. We also have untenable collective bargaining rules, untenable social handouts, and untenable union wages and benefits.""....Source HERE

Christmas is the deadliest Holiday of the year! Be careful out there....

Be careful out there!! Looking at the graphic, it is amazing to see the change in deaths over Christmas/New Year break...Am I too morbid?

"""A new U.S. analysis of mortality rates during different times of year found that people are more likely to die during the holidays — notably on Christmas and New Year’s Day — and researchers cannot explain the yearly spike.

After analyzing all official United States death certificates over the 25-year period between 1979 and 2004, a trio of sociologists identified an excess of 42,325 natural deaths — that is, above and beyond the normal seasonal winter increase — in the two weeks starting with Christmas..."" Source HERE

The angst over shopping for Christmas is not a new thing...The more things change, the more they stay the same...

In what year do you think this quote from the NYTIMES was made? (Click HERE to see the answer)

""It is astonishing to see what lengths some people will go to in giving presents at Christmas. I am told they will borrow, go in debt, or even steal to gratify their desires. The ladies get the worst of it, of course. It requires great skill to manage the whole business successfully and economically. I was told by a lady friend not long ago that in her exchanges last Christmas one of her friends returned, through a mistake, the gift she had sent to her the year before."" (HT: Division of Labour)

My letter to the NYTIMES regarding an Op-Ed piece by Larry David---Just like George, he presents only half the story

A letter I sent to the NY TIMES regarding an opinion piece (see below) by Larry David (co-creator of "Seinfeld:")

Published: December 20, 2010

""I assume Larry David is a high-income earner as a result of his God-given talent and entrepreneurial skills, and not as a result of an inheritance or a trust-fund. I am a bit perplexed as to why he chose to focus only on his demand-side participation in the economy and not on his immense ability to affect the supply-side. After all, it was his “supply-side self” that produced his wealth and, on net, improved the entertainment value of television, wasn’t it? Yes, he could use his money to purchase all those luxury items but he could also pool it with other like-minded entertainer’s or entrepreneurs who feel they have somehow received ill-gotten gains from this “tax-cut”, and create a new show or fund ANY other type of business that would actually create and maintain new jobs in the economy. Make lemonade out of lemons, Mr. David. Now THAT would be a show about something!""

Published: December 20, 2010

THERE is a God! It passed! The Bush tax cuts have been extended two years for the upper bracketeers, of which I am a proud member, thank you very much. I’m the last person in the world I’d want to be beside, but I am beside myself! This is a life changer, I tell you. A life changer!

To begin with, I was planning a trip to Cabo with my kids for Christmas vacation. We were going to fly coach, but now with the money I’m saving in taxes, I’m going to splurge and bump myself up to first class. First class! Somebody told me they serve warm nuts up there, and call you “mister.” I might not get off the plane!

I’m also going to call the hotel and get another room so I don’t have to sleep on a cot in the kids’ room. Don’t get me wrong — I love a good cot. The problem is they tend to take up a lot of room, and it’s getting a little tougher in my advancing years to fold it up and drag it to the closet. I mean, I’d do it if I had to, but guess what? I don’t! Not with this windfall coming my way. Now I get to have my own room with a king-sized bed. And who knows, maybe I’ll even get some fancy bottled water from the minibar. This is shaping up to be the best vacation I’ve had in years.

When I get home, thanks to the great compromise, the first thing I’m going to do is get a flat-screen TV. Finally I can throw out the 20-inch Zenith with the rabbit ears, the one I inherited from my parents when they died. The reception is terrible and I’m getting tired of going out to bars every time I want to watch a game. Last month, the antenna broke and I tried to improvise one with a metal hanger and wound up cutting myself. Every time I see that scab, I say to myself, “If, God willing, those Bush tax cuts are restored, I’m going to buy a new TV.” Well, guess what? They have been!

It’s also going to be a boon for my health. After years of coveting them, I’ll finally be able to afford blueberries. Did you know they have a lot of antioxidants, which prevent cancer? Cancer! This tax cut just might save my life. Who said Republicans don’t support health care? I’m going to have the blueberries with my cereal, and I’m not talking Special K. Those days are over. It’s nothing but real granola from now on. The kind you get in the plastic bins in health food stores. Did someone say “organic”?

The only problem is if, God forbid, the tax cuts are repealed in two years, how will I ever go back to Special K and bananas? Well, I did quit smoking, so I’m sure if push came to shove I could summon up the willpower to get off granola and blueberries. Of course, I suppose with the money I managed to save from the “Seinfeld” syndication, I probably could continue to eat granola with blueberries, but let’s hope it doesn’t come to that.

Life was good, and now it’s even better. Thank you, Republicans. And a special thank you to President Obama and the Democrats. I didn’t know you cared.

Larry David appears in the HBO series “Curb Your Enthusiasm.”

Monday, December 20, 2010

Did you get a Flu Shot this year? If you did not, then you really messed up the market for flu vaccine. See the supply and demand analysis within! No, it is not as bad as having the flu, I promise...

WSJ: Flu-Shot Demand Droops; Prices Fall

""Drugstores, supermarkets and some doctors' offices are slashing prices or offering other kinds of deals on flu vaccine this year amid weaker-than-expected demand.

Last fall, hordes of worried parents, pregnant women and others drove demand for a limited supply of H1N1 flu vaccine as the swine-flu pandemic spread across the country, eventually infecting an estimated 61 million people in the U.S. and killing more than 12,000.

Demand for the separate, seasonal flu shot also was strong, largely because of the hysteria surrounding H1N1. Most venues ran out of seasonal flu vaccine by early November.

This year, supplies of the seasonal flu shots are bigger than ever: Manufacturers produced and distributed 163 million doses of the vaccine, compared with the 110 million doses distributed last year. Retailers and doctors' offices stocked up, pushing inoculations earlier and harder in the belief that heightened awareness of flu and a new government recommendation that all Americans over six months of age should get inoculated would drive strong demand....""

A couple of things are going on here that affected the market for flu shots. There was an anticipation that the demand for flu shots would be greater than last year because of the swine flu epidemic and an increased awareness of the dangers of not being inoculated. In response to this anticipated demand, manufacturers increased the supply of vaccine, relative to the quantity produced last year. This is ripe for a basic supply and demand analysis...with graphs!!!

The first graph shows the market in equilibrium BEFORE the market shift in demand and supply. Using the numbers in the article, the market price is $25 and the market quantity is 110 million, point "A". Assume the market "clears" at this price and quantity.

The next graph shows the INCREASE in Supply of Flu Vaccine. The Supply curve shifts to the RIGHT (S* to S1) to show that at every price, the quantity supplied of vaccine is 53 million units GREATER, relative to S* (163 million vs 110 million).

Simultaneously, we will assume the presumed anticipated increase in demand occurs. In the next graph, the demand curve shifts to the right (D* to D1), indicating that at every price, the quantity demanded of vaccine is 53 million units GREATER, relative to D* (163 vs 110).

Our market is back at the same equilibrium price ($25) BUT at at higher market quantity (163 million), point "B". It all works out, right???

The article suggests that Demand did not respond as anticipated for a variety of reasons. Lets assume that Demand did NOT shift all BUT retailers and doctors did not recognize this immediately and the try to maintain the $25 price for the vaccine. How does this affect the market?

Our market is out of equilibrium. Let's clear the clutter of this graph and look at simplified one below. At $25 the quantity demanded is 110 million units (point "A"), but the quantity supplied is 163 million units (point "B")--Quantity Demanded does not equal Quantity Supplied! In fact the Quantity Supplied EXCEEDS the Quantity Demanded by 53 million units, which means we have a SURPLUS of vaccine.

How does a market "clear" this surplus? Shown below, by decreasing the price and moving ALONG the DEMAND curve (point "A" to Point "C") increasing the quantity demanded at the lower price. Moving ALONG the SUPPLY curve (Point "B" to "C"), decreasing the quantity supplied at the lower price. A new market clearing price ($15) and market quantity (140) are established.

Sunday, December 19, 2010

A Primer on the role of Payroll Taxes in the latest Tax Bill set to become law and how it relates to Demand-Side and/or Supply-Side Economics...

Many students work part-time jobs but most don't understand their paychecks, or more specifically, the two primary tax deductions that come out of their paychecks. It is important to understand these two taxes because the latest tax bill compromise between the President and Congress to stimulate the economy is going to affect YOUR paycheck very soon.

Almost all private sector workers pay TWO mandatory payroll taxes: Social Security and Medicare. Both of these taxes are targeted to paying benefits to retirees and other designated beneficiaries for living expenses (Social Security) and medical expenses (Medicare).

The Social Security Tax is 6.2% and the Medicare Tax is 1.45% of your gross pay. So, for example, if you earn $10 per hour and you work 10 hours a week your gross pay is $100. On this amount you would pay $6.20 in Social Security taxes and $1.45 in Medicare taxes. Bottom line: you pay $6.20 (Social Security) and $1.45 (Medicare) , or a total of $7.65, for every $100 you earn.

This is not the whole story on these two taxes:

That is right---your employer matches the amounts that are sent to their respective trust funds in Washington, DC. The Social Security portion has a cap on the amount that is subject to the tax--$106,800. The maximum amount someone would pay into Social Security in any given year is $6,621.06. However, there is NO cap on the earned income that is subjected to the Medicare tax. Keep in mind, the portion your employer pays for these two taxes does not come out of your paycheck BUT is a cost to them to employ you. While you are paid a set wage ($10 per hour) it actually costs more than that to employ you--at this point that would be $10.76 ($10 times 7.65%, the employers portion of the taxes).

Congress and/or the President had two choices: reduce the Social Security tax on workers, a Demand-Side stimulus OR on employers, a Supply-Side stimulus.

The current tax bill will reduce the Social Security tax from 6.20% to 4.20% for 2011. This is on YOUR portion of the Social Security tax, NOT the employers. The Medicare tax will stay the same. What this means for you, using our example above, is you are going to have an additional $2.00 per $100 you earn in your paycheck. So, for a worker who earns $500 per week, they will have $10 extra dollars in each paycheck.

Congress and the President opted for a Demand-Side stimulus for the economy.

Here is the reasoning: workers have more money in their paychecks; they will buy more goods and/or services; businesses will sell/produce more goods/services to meet this increased demand; businesses will hire more workers to sell/produce these additional goods/services; newly employed people are now income earners; they will, in turn, buy more goods/services from other businesses that are responding in kind; the economic "pump" has been "primed"...DEMAND CREATES SUPPLY!

Here is the alternative, Supply-Side argument they could have chosen instead: reduce the Social Security portion employers pay for each worker; this reduces the cost of employing labor (which is the largest cost for most businesses); employers "at the margin" of deciding to hire workers will employ more labor; these workers produce goods/services at a lower marginal cost than before; businesses produce more goods/services; the newly employed people are now income earners; they will, in turn, buy more goods/services from other businesses that are responding in kind; the economic "pump" has been "primed"... SUPPLY CREATES DEMAND!

What BOTH ultimately come down to in the current economic climate is this: WHICH path would encourage the hiring of workers by businesses. The lynch-pin is business behavior: Will the Demand-Side policy increase demand enough that businesses collectively hire more workers, or will they see this bump in demand as temporary and make do with existing workers. Would the Supply-Side policy produce the same result--employers collectively not hiring regardless of the reduction in the cost of hiring workers, because they know the tax relief is temporary and they don't want to take on new employees if they are uncertain about future economic conditions.

Yikes!! What would you do? Given the current economic conditions, GDP is increasing but hiring is not at a significant level ("a jobless recovery"), which policy option would you choose? Extra credit on the final is at hand!!

Almost all private sector workers pay TWO mandatory payroll taxes: Social Security and Medicare. Both of these taxes are targeted to paying benefits to retirees and other designated beneficiaries for living expenses (Social Security) and medical expenses (Medicare).

The Social Security Tax is 6.2% and the Medicare Tax is 1.45% of your gross pay. So, for example, if you earn $10 per hour and you work 10 hours a week your gross pay is $100. On this amount you would pay $6.20 in Social Security taxes and $1.45 in Medicare taxes. Bottom line: you pay $6.20 (Social Security) and $1.45 (Medicare) , or a total of $7.65, for every $100 you earn.

This is not the whole story on these two taxes:

Both the Social Security tax and the Medicare tax must be matched by the employer. This means the employer must remit to the federal government 12.4% of each employee’s first $106,800 of taxable earnings plus 2.9% of each employee’s earnings regardless of amount. (Source)

That is right---your employer matches the amounts that are sent to their respective trust funds in Washington, DC. The Social Security portion has a cap on the amount that is subject to the tax--$106,800. The maximum amount someone would pay into Social Security in any given year is $6,621.06. However, there is NO cap on the earned income that is subjected to the Medicare tax. Keep in mind, the portion your employer pays for these two taxes does not come out of your paycheck BUT is a cost to them to employ you. While you are paid a set wage ($10 per hour) it actually costs more than that to employ you--at this point that would be $10.76 ($10 times 7.65%, the employers portion of the taxes).

Congress and/or the President had two choices: reduce the Social Security tax on workers, a Demand-Side stimulus OR on employers, a Supply-Side stimulus.

The current tax bill will reduce the Social Security tax from 6.20% to 4.20% for 2011. This is on YOUR portion of the Social Security tax, NOT the employers. The Medicare tax will stay the same. What this means for you, using our example above, is you are going to have an additional $2.00 per $100 you earn in your paycheck. So, for a worker who earns $500 per week, they will have $10 extra dollars in each paycheck.

Congress and the President opted for a Demand-Side stimulus for the economy.

Here is the reasoning: workers have more money in their paychecks; they will buy more goods and/or services; businesses will sell/produce more goods/services to meet this increased demand; businesses will hire more workers to sell/produce these additional goods/services; newly employed people are now income earners; they will, in turn, buy more goods/services from other businesses that are responding in kind; the economic "pump" has been "primed"...DEMAND CREATES SUPPLY!

Here is the alternative, Supply-Side argument they could have chosen instead: reduce the Social Security portion employers pay for each worker; this reduces the cost of employing labor (which is the largest cost for most businesses); employers "at the margin" of deciding to hire workers will employ more labor; these workers produce goods/services at a lower marginal cost than before; businesses produce more goods/services; the newly employed people are now income earners; they will, in turn, buy more goods/services from other businesses that are responding in kind; the economic "pump" has been "primed"... SUPPLY CREATES DEMAND!

What BOTH ultimately come down to in the current economic climate is this: WHICH path would encourage the hiring of workers by businesses. The lynch-pin is business behavior: Will the Demand-Side policy increase demand enough that businesses collectively hire more workers, or will they see this bump in demand as temporary and make do with existing workers. Would the Supply-Side policy produce the same result--employers collectively not hiring regardless of the reduction in the cost of hiring workers, because they know the tax relief is temporary and they don't want to take on new employees if they are uncertain about future economic conditions.

Yikes!! What would you do? Given the current economic conditions, GDP is increasing but hiring is not at a significant level ("a jobless recovery"), which policy option would you choose? Extra credit on the final is at hand!!

Saturday, December 18, 2010

Getting medical care for peanuts. No, really, getting medical care for peanuts..It is a sign of the times...

This is what happens in the extreme when people and institutions lose faith in the currency. Zimbabweans have essentially abandoned their currency and are using various commodities for exchange purposes. Local heathcare providers have established a price list that gives a commodity-to-US Dollar "exchange rate"...See photo below...

NYTIMES: Zimbabwe Health Care, Paid With Peanuts

""People lined up on the veranda of the American mission hospital here from miles around to barter for doctor visits and medicines, clutching scrawny chickens, squirming goats and buckets of maize. But mostly, they arrived with sacks of peanuts on their heads....""

NYTIMES

Which is better for the environment, fake Christmas trees or real ones? The answer may surprise you...

Which is better for the environment, fake Christmas trees or real? If you are trying to conserve trees, then fake is the way to go. But if you are trying to conserve resources overall and minimize your "carbon footprint", then the choice is not so clear...

NYTIMES: How Green Is Your Artificial Christmas Tree? You Might Be Surprised

NYTIMES: How Green Is Your Artificial Christmas Tree? You Might Be Surprised

""Kim Jones, who was shopping for a tree at a Target store in Brooklyn this week, was convinced that she was doing the planet a favor by buying a $200 fake balsam fir made in China instead of buying a carbon-sipping pine that had been cut down for one season’s revelry.

“I’m very environmentally conscious,” Ms. Jones said. “I’ll keep it for 10 years, and that’s 10 trees that won’t be cut down.”

But Ms. Jones and the millions of others buying fake trees might not be doing the environment any favors.

In the most definitive study of the perennial real vs. fake question, an environmental consulting firm in Montreal found that an artificial tree would have to be reused for more than 20 years to be greener than buying a fresh-cut tree annually. The calculations included greenhouse gas emissions, use of resources and human health impacts.

“The natural tree is a better option,” said Jean-Sebastien Trudel, founder of the firm, Ellipsos, that released the independent study last year""

“You’re not doing any harm by cutting down a Christmas tree,” said Clint Springer, a botanist and professor of biology at Saint Joseph’s University in Philadelphia. “A lot of people think artificial is better because you’re preserving the life of a tree. But in this case, you’ve got a crop that’s being raised for that purpose.”

We don't have a trade deficit with China anymore!! So why all the protectionist talk?

Well, it has not been entirely eliminated, but is it nearly as bad as it is portrayed? As with many (most?) economic statistics, Gross Domestic Product (GDP) accounting is very imperfect and often misleading measure of a country production of goods and services. Finished goods are called "outputs" and all the components that go into making the finished good are called "inputs". GDP does not count the market value of inputs because they are not in their "final end-use condition"--they are just on their way into making a final good. This is not really a problem if all the inputs are produced in the same country they are assembled. The problem arises when the supply chain becomes globalized and the component parts come from multiple countries. Under traditional GDP measure, the country at the end of the production chain gets full "credit" for the market value of the good, even if they contribute very little to the overall value of the good. The point of the article below is that this distorts the trade situation with China, which in large part is the final assembly point for lots of high-value inputs produced elsewhere. The i-Phone is used as an example of how GDP accounting affects the trade balance with China. The inputs are high-value production and the assembly is low-value. However, the countries that produced the high value items get no GDP accounting credit for what they produce, ONLY the GDP debit for importing it and consuming it...Perhaps a new measure of GDP is in order to keep up with globalization???

WSJ: Not Really 'Made in China'

WSJ: Not Really 'Made in China'

Trade statistics in both countries consider the iPhone a Chinese export to the U.S., even though it is entirely designed and owned by a U.S. company, and is made largely of parts produced in several Asian and European countries. China's contribution is the last step—assembling and shipping the phones.

So the entire $178.96 estimated wholesale cost of the shipped phone is credited to China, even though the value of the work performed by the Chinese workers at Hon Hai Precision Industry Co. accounts for just 3.6%, or $6.50, of the total, the researchers calculated in a report published this month.

Wednesday, December 15, 2010

Nice graphic on how some things have changed since the year 2000...

Technology use by the masses has really taken off in 10 years...Quite incredible if you stop to think about it...The price of gas intrigued me. From 2000 until today (roughly $2.89) the price has increased 95%. Taking into account inflation, $1.48 in 2000 is the equivalent to $1.88 today (inflation calculator HERE). In other words, if gas prices had simply increased in price along with the prices of everything else, as measured by the Consumer Price Index (CPI), we should be able to buy gas for $1.88 a gallon (a 27% increase).

|

| Source HERE |

Tuesday, December 14, 2010

All I want for Christmas is for students to properly label their graphs...Really, that is all I want...

|

| Chartporn |

Monday, December 13, 2010

News Headlines: "US imposes tariffs on Chinese tires"..."Traffic fatalities increase at an alarming rate"---How are these two stories related?

From WSJ: WTO Backs US in Tire Dispute with China

The World Trade Organization Monday sided with the U.S. over tariffs the Obama administration imposed last year on Chinese tires, in a high-profile case likely to stoke tensions in coming U.S.-China trade talks.

The WTO dispute-settlement panel ruled in favor of President Barack Obama's decision from September 2009 to levy tariffs of as much as 35% on Chinese tires under a rarely used safeguard provision to protect against import surges, provoking one of the biggest trade spats between the two countries in recent years. In addition to taking the case to the WTO, China retaliated by announcing a series of duties on U.S. chicken, nylon and other exports.

No "harm to workers and industries" in the protected industries, but what about the harm to consumers who have to pay more for not only Chinese tires, but American tires as well...Oh, wait, you did not think American tire producers would keep their prices the same now that they got the tariff imposed...did you?

U.S. Trade Representative Ron Kirk called the decision a "major victory" that demonstrates the solid legal underpinnings of U.S. trade remedy laws.

"This outcome demonstrates that the Obama administration is strongly committed to using and defending our trade remedy laws to address harm to our workers and industries," Mr. Kirk said in his statement.""

The Chinese tires are of the lower end of the market type tires that, in general, lower income people purchase. So the effect WILL BE (I don't mince words here) delayed purchase/replacement of tires by this group, which in turn means more unsafe tires on the road, which in turn means more traffic accidents, which in turn means more injuries/fatalities "at the margin".

The lesson here is one of "rent-seeking"---the use of government to confer benefits on the few (the tire industry and their workers/Unions) at the expense of the many (everyone else who buys tires). The benefits are concentrated while the costs are diffuse. Mr Kirk's statement could be worded like this too and not lose its meaning:

"This outcome demonstrates that the Obama administration is strongly committed to using and defending our trade remedy laws toIs this too harsh? Tell me where I am going wrong...addressimpose harmtoon ourworkersconsumers andindustriestheir families ," Mr. Kirk said in his statement.""

Subscribe to:

Posts (Atom)