""The U.S. cattle herd has shrunk to levels not seen since 1958, a harbinger of higher beef prices.

The biannual inventory report released Friday by the U.S. Department of Agriculture puts the nation's herd at 92.582 million head as of Jan. 1. The supply of cattle in the U.S. has been falling steadily as feed costs rise, available pasture land shrinks and robust prices for young cattle provide a strong incentive for producers to cash out.

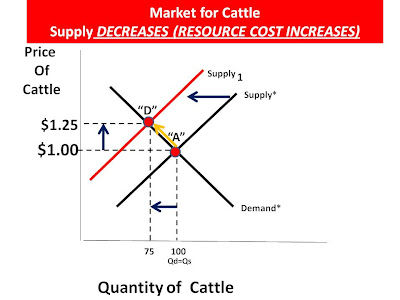

Prices for young cattle, known as "feeders" in the industry, also hit record highs recently, and analysts say such robust prices are helping to drive the ongoing declines in the U.S. herd. The immediate cash price for feeder cattle is too tempting to pass up, so producers opt to sell rather than keep young females for breeding, which can take two years before producing returns. Yet prices aren't likely to pull back until more young cattle are marked for breeding instead of being sold to feed lot operators to be fattened for beef.Two things are going on here to thin the herd of cattle in the US. One is the cost of feed (an input price) is increasing, hence that increases the cost of producing cattle. The other is a sell-off of "young feeders". Let's look at the cost of feed first. Graphically, this is shown by the following (I use a fictitious price for cattle AND the increase in resource price--just reference prices and for simplicity):

The cost of feed for cattle has increased in price (that is another blog entry). Assume it has increase by $.50. Now the cost to the rancher to raise 100 head of cattle is $1.00 plus $.50---$1.50:

What is true at 100 head of cattle is going to be the same at every price and quantity supplied combination

on Supply*--the cost is going to increase by $.50:

We now have a series of Price and Quantity Supplied combinations that lie to the left of Supply*. Connect those points and we have a new supply curve, "Supply 1":

Since there is an increase in the price of cattle, driven on the supply-side, we move ALONG Demand*, up and to the left, to Point "D". In other words, as the price increases ($1.25) the quantity demanded decreases (75). This is what the Law of Demand suggests. Note: The market price does not increase by the full $.50. Some is absorbed by the producer and some by the demander. How much each absorbs is dependent on their relative elasticities (a micro topic)

The second reason for a decrease in the supply of cattle is the selling of "feeder cattle", including females, for fattening instead of breeding. This simply will decrease the number of cattle available at every price. Graphically:

This one is a little easier to see. There will be, in absolute terms, fewer (assume 25) cattle supplied ("quantity supplied) at every price:

We have a series of Price and Quantity Supplied combinations that lie to the left of Supply*. If you connect these points we have a new supply curve, "Supply 1".

We reach a new equilibrium price where quantity demanded = quantity supplied at $1.25.

The combination of an increase in inputs costs and a thinning of the heard for an immediate pay-off will result in higher cattle prices, hence beef prices at the retail level. Now, it will be up to the demand-side to make its move. Are there viable substitutes for beef which will decrease the demand for beef as consumers chase after a cheaper source of meat? That is known as the "substitution effect"...We will save that for class....

No comments:

Post a Comment